The euro started its first weekly trading with a noticeable rise within the expected bullish context during last Friday’s analysis. It managed to breach 1.0670 resistance level, to reach its highest level during the morning trading of the current session at 1.0762.

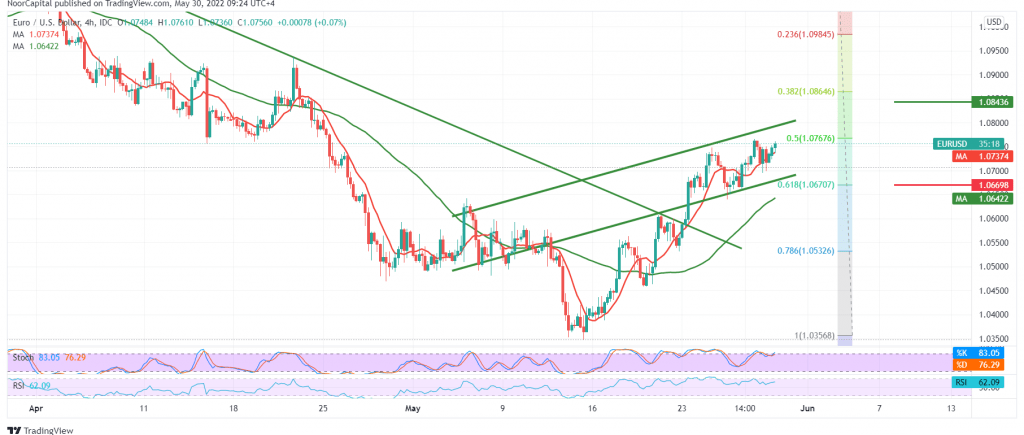

Technically, the euro is now hovering around the 1.0770 level represented by the 50.0% Fibonacci correction. It represents a pivotal level for the pair’s trading today. With careful consideration of the 4-hour chart, the simple moving averages continue to hold the price from below, supporting the bullish price curve. Moreover, the 14-day momentum indicator continues defending the daily bullish trend.

To confirm the continuation of the rise, we only need to witness cohesion for the pair above 1.0770, and that is a motivating factor capable of enhancing the chances of touching 1.0800 next price station, whose targets may extend towards the extended resistance 1.0860/1.0840.

To remind that the stability of intraday trading above 1.0690, and most importantly 1.0670 61.80% correction is an important and necessary condition to maintain the bullish daily trend, noting that breaking 1.0670 previously breached resistance-into-support, 61.80% correction support level, will immediately stop the bullish bias and lead the pair to the official descending path to retest 1.0610 initially.

Note: Low volume trading due to “Memorial Day”.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0720 | R1: 1.0780 |

| S2: 1.0670 | R2: 1.0840 |

| S3: 1.0610 | R3: 1.0895 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations