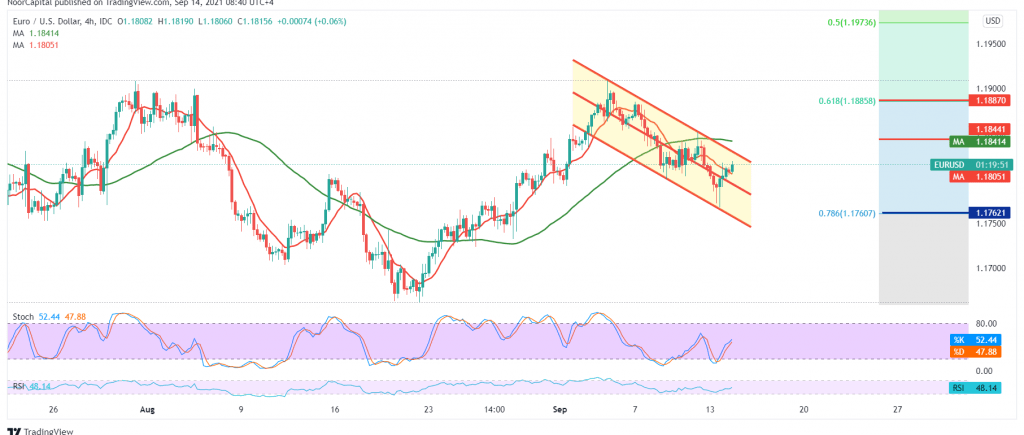

The euro managed to achieve the negative outlook as expected, touching the first official target that must be gained during the previous analysis at 1.1765, recording the lowest price at 1.1770.

On the technical side, the current moves are witnessing a slight bullish slope due to taking advantage of the support level represented by our target 1.1765 within attempts to retest the resistance level 1.1840/1.1850.

With a closer look at the 4-hour chart, we find stochastic is trading with negativity and started losing the bullish momentum, in addition to the stability of the intraday trading below 1.1840/1.1850.

Therefore, we maintain our negative outlook, knowing that breaking 1.1780 will facilitate the task required to visit 1.17550, 1.1710/1.1700 is an awaited next stop.

Above 1.1880, the 61.80% Fibonacci correction will immediately stop the expected bearish scenario, and the euro will recover again and witness an ascending path whose initial target is around 1.1930.

| S1: 1.1780 | R1: 1.1850 |

| S2: 1.1750 | R2: 1.1880 |

| S3: 1.1710 | R3: 1.1930 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations