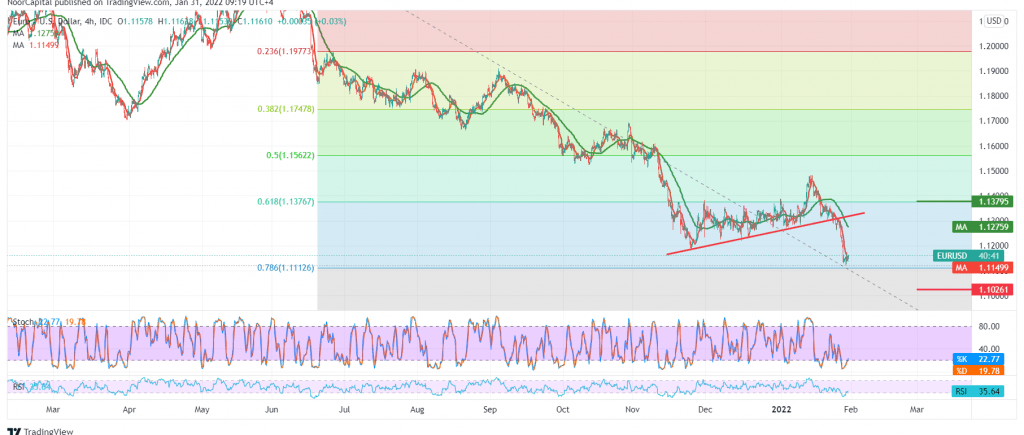

The single European currency declined during last Friday’s trading, gradually approaching the psychological support level of 1.1100, to record its lowest level around 1.1120.

Technically, the euro is challenging to confirm breaking 1.1100, and the current moves are witnessing stability above the mentioned level. Furthermore, by looking at the 60-minute chart, we notice the positive attempts of the 14 momentum indicator today to obtain bullish momentum, which contradicts the continuation of the negative pressure coming from the EMA50 Day, which is an obstacle to the pair.

With the technical signals conflicting, we wait for the trend to be more accurate, waiting for one of the following scenarios:

The pair succeeded in confirming the breaking of the solid support floor 1.1100, which may constitute a negative pressure factor on the euro. As a result, we may witness the resumption of the bearish trend to visit 1.1060, and losses may extend towards 1.1010.

Suppose the euro succeeds in building a base on the 1.1100 support floor and re-establishing stability above 1.1235. In that case, this increases the possibility that we will witness an ascending path that aims to retest 1.1370, the 61.80% Fibonacci correction.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 1.1130 | R1: 1.1230 |

| S2: 1.1095 | R2: 1.1270 |

| S3: 1.1060 | R3: 1.1330 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations