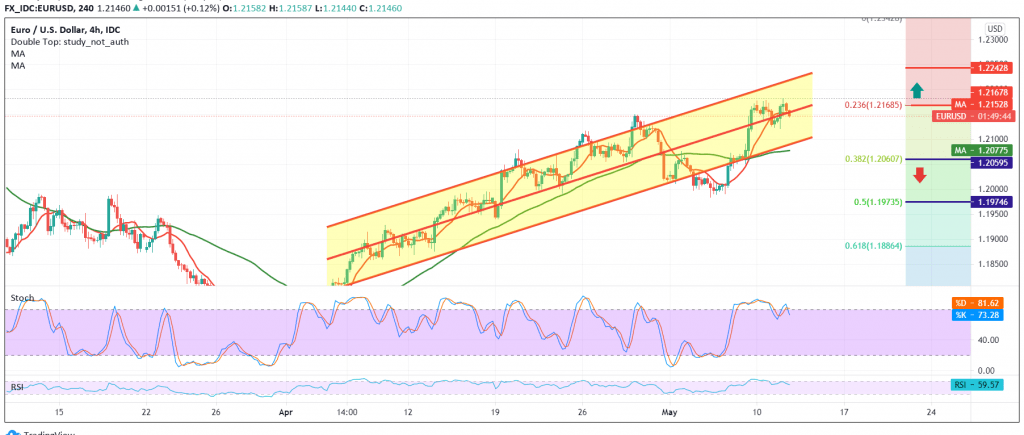

Negative trading dominated the movements of the euro against the US dollar within the bearish corrective tendency mentioned in the previous analysis, targeting 1.2085 to record the lowest level at 1.2120.

Technically, and with a closer look at the 60-minute chart, we find the euro is still stable below the pivotal resistance at 1.2170 represented by the 23.60% Fibonacci correction, in addition to the negative features that continue to dominate the stochastic indicator.

Consequently, we will maintain our negative outlook, continuing towards the first target of 1.2085, and then 1.2020/1.2010 a next stop.

Only from the top, to move upwards and stabilize again above the aforementioned resistance level 1.2170/1.2180, will stop the bearish tendency and recover the pair, with the aim of re-testing 1.2205/1.2210, and gains may extend later towards 1.2240.

| S1: 1.2085 | R1: 1.2170 |

| S2: 1.2010 | R2: 1.2205 |

| S3: 1.1975 | R3: 1.2240 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations