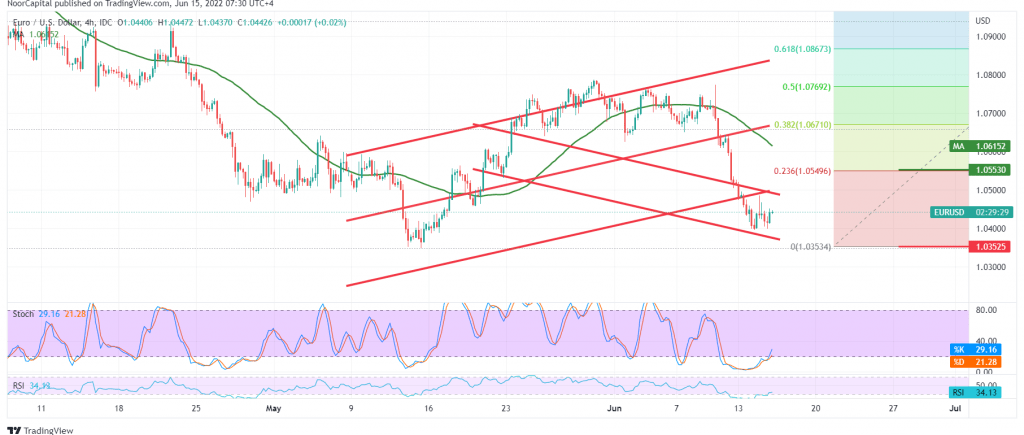

The euro continues to decline against the US dollar within a solid bearish trend that dominates the pair’s movements, as we expected, touching the target price station during the last report at 1.0430, recording its lowest level during the previous trading session 1.0397.

On the technical side today, and with careful consideration of the 4-hour chart, we find the 50-day simple moving average that continues to negatively pressure the price from the top, supporting the bearish price curve, on the other hand, we find positive crossover signs that started appearing on stochastic.

Despite the conflict between the leading technical signals, we believe there is a possibility of a bullish bias in the coming hours to retest 1.0485 and 1.0550, a correction of 23.60%.

Note: the limited bullish bias does not contradict the general bearish trend, which is still its next official target at 1.0350, and it may extend towards 1.0300 once 1.0400 is broken.

Note: the markets are waiting for important data that could lead to volatility; US Retail Sales, Interest Rate, Federal Reserve Statement & Press Conference

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0400 | R1: 1.0485 |

| S2: 1.0350 | R2: 1.0530 |

| S3: 1.0305 | R3: 1.0570 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations