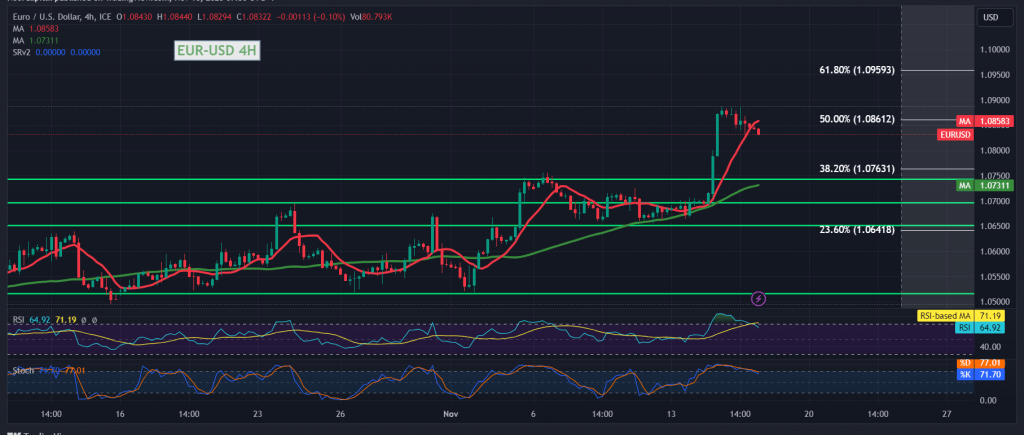

The Euro/Dollar pair experienced a predominance of negative trades in the prior trading session, as it hit its zenith at 1.0886, but encountered resistance at this level that effectively curtailed its upward trajectory. As we outlined in our previous technical report, a one-hour candle closing below 1.0860 could exert downward pressure on the price, altering the current trend.

Today’s technical analysis, based on the 4-hour chart, reveals the emergence of negative crossover signals on the Stochastic indicator, indicating a gradual loss in upward momentum. This is coupled with distinct negative signals on the 14-day Momentum indicator.

Over the coming hours, there’s a potential for the trend to shift lower, aiming for a retest of the 1.0800 mark as the initial target. It’s important to note that slipping below this level could exacerbate the pair’s losses, leading to a visit to the previously breached resistance now acting as a support level of 1.0760, representing a 38.20% correction. This is our primary target, though the decline could potentially extend further towards 1.0640.

On the other hand, if the price consolidates above 1.0870, it would effectively halt the anticipated downward trend, and the pair could resume its upward trajectory, with initial targets at 1.0920 and subsequent ones at 1.0960 – a Fibonacci retracement of 61.80%, serving as a crucial point.

It’s worth noting that the 50-day simple moving average continues to offer a positive incentive.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations