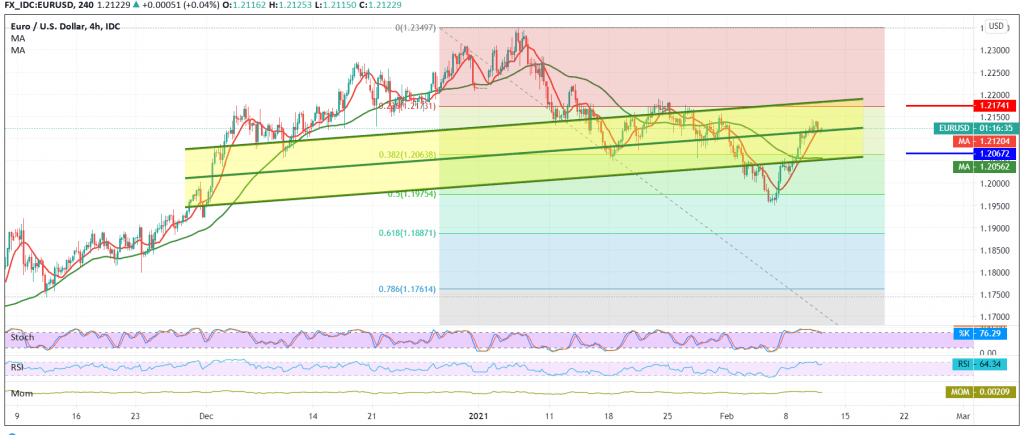

Quiet trading dominated the movements of the euro against the US dollar during the previous trading session, in a positive path, posting a high of 1.2144.

On the technical side today, and by looking at the 60-minute chart, we find that there is a beginning of a decline in momentum, as we see the euro finding a strong resistance level around 1.2155, the 50-day moving average is pressing the price from the top.

We tend to be negative in our intraday trading, targeting a re-test of 1.2065 Fibonacci retracement of 38.20%, as shown on the chart.

Note: Confirmation of breaking 1.2065 is capable of pressing the price to target 1.2020. Trading again and confirming the breach of 1.2155 motivates the price to head towards 1.2175, a correction of 23.60%.

Note: the scenario of retesting the support does not contradict the bullish trend, with official targets around 1.2175.

| S1: 1.2065 | R1: 1.2155 |

| S2: 1.2020 | R2: 1.2185 |

| S3: 1.1975 | R3: 1.2235 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations