The euro provided calm trading that tended to be positive against the US dollar within the expected bullish path mentioned in the previous analysis, gradually approaching the awaited target of 1.2130, recording its highest level at 1.2117.

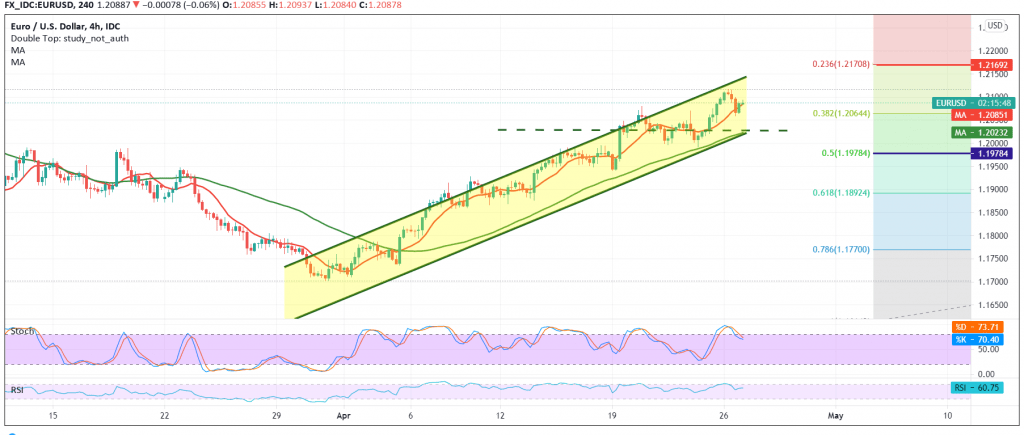

Technically speaking today, the 50-day moving average is still holding the price from below in support of a continuation of the gradual rise, and on the other hand, the current movements of the euro are affected by the clear negative features on the stochastic, which coincides with the loss of the RSI bullish momentum on short time frames.

Despite the conflicting technical signals, we tend to be positive with the intraday trading remaining above the support level of 1.2060, the correction of 38.20%, and in general above 1.2030 targeting 1.2130/1.3135 as a first target, and then 1.2175, an official station awaited that is the 23.60% correction.

Note: stochastic negativity may push the pair to re-test 1.2060 before attempting to rise again.

Note: If the pair is confirmed to break the support level of 1.2030, this will immediately stop the continuation of the attempts to rise today, and we will witness negative pressure targeting 1.1975, a 50.0% retracement.

| S1: 1.2030 | R1: 1.2135 |

| S2: 1.1975 | R2: 1.2175 |

| S3: 1.1925 | R3: 1.2235 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations