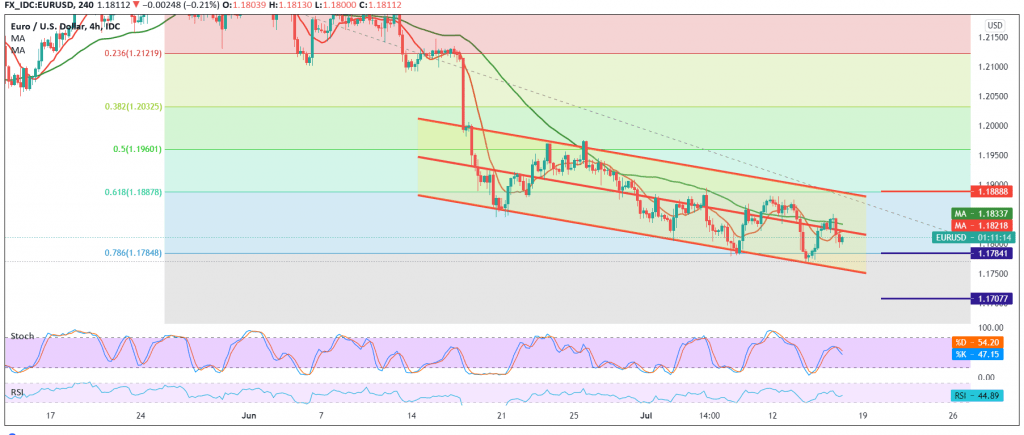

It has limited sideways trading that dominated the euro’s movements against the US dollar during the previous trading session within a gradual bearish tendency to the downside, touching the first target of 1.1810, recording a low at 1.1796.

Technically, the current movements are witnessing a slight bullish slope. However, there are still limited attempts due to the stability of the intraday trading below the resistance level of 1.1850 and below the pivotal resistance level of 1.1880, the 61.80% Fibonacci correction.

The negative pressure of the 50-day moving average, which still constitutes an obstacle preventing the pair from rising. Therefore, we will maintain our negative expectations, knowing that the stability of trading below 1.1800 facilitates the task required to visit 1.1745, and the downside targets extend towards 1.1710, the next official station.

From above, the stability of trading and stability above 1.1880 will stop the bearish scenario, and we may witness a bullish bias whose initial target is 1.1930, while its second target is around 1.1975, 50.0% correction.

| S1: 1.1775 | R1: 1.1850 |

| S2: 1.1745 | R2: 1.1880 |

| S3: 1.1705 | R3: 1.1930 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations