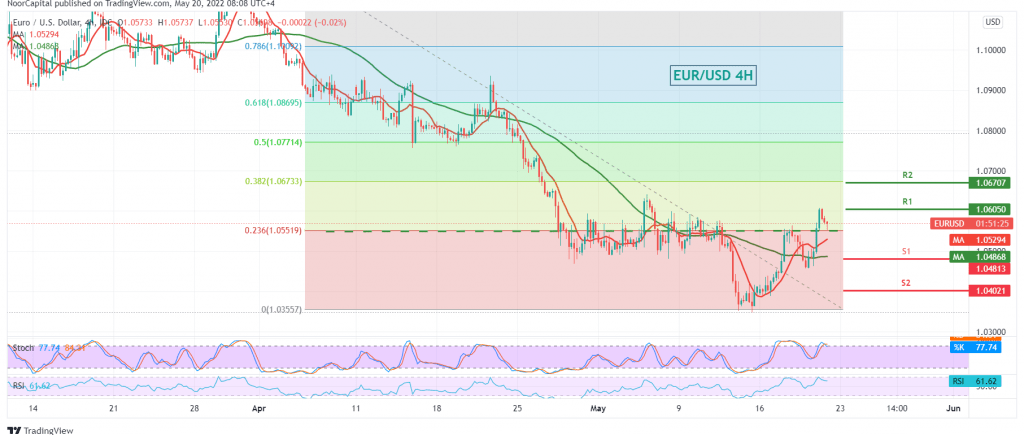

The support levels published during the previous report at 1.0460, managed to limit the bearish bias, as the euro successfully retested the mentioned level, trying to maintain stability above the resistance level of the psychological barrier of 1.0500.

Technically today, and by carefully looking at the 240-minutes, we notice the conflicting technical signals. We found the stochastic that loses the bullish momentum and supports the possibility of descending. On the other hand, the pair is stable above 1.0460, 50.0% Fibonacci correction, and the 50-day moving average still provides a positive incentive and meets It is near 1.0460 and it adds more strength.

With this conflict, we prefer to monitor the price behavior of the pair to be waiting for one of the following scenarios:

Activating the short positions depends on confirming the break of 1.0460, the 50.0% Fibonacci retracement, and that facilitates the task required to visit 1.0400 as an initial station, its bearish targets may extend towards 1.0350.

Activating long positions requires that we witness a clear breach of the resistance level at 1.0550, and that is a catalyst that enhances the chances of touching 1.0610 and then 1.0650, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0480 | R1: 1.0630 |

| S2: 1.0400 | R2: 1.0690 |

| S3: 1.0335 | R3: 1.0775 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations