The single European currency achieved the official target required to be at 1.1220 areas, to record its lowest level at 1.1220 and return to the bullish rebound, taking advantage of the demand level represented by the target.

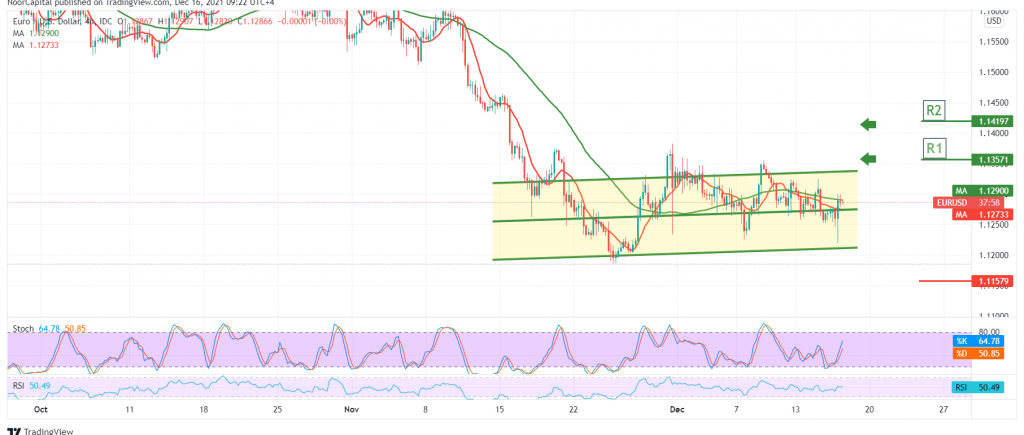

Technically, we find the pair stable above 1.1220, and we notice that the 14-day momentum indicator provides more positive signs that come in conjunction with the stochastic’s attempt to get more bullish momentum, on the other hand, the 50-day moving average is still an obstacle in front of the pair and meets around 1.1300.

With the conflicting of the leading technical signals, we prefer to stand aside for the moment, to obtain a high-quality deal and to maintain the profitability rates that were achieved during yesterday’s session, to be in front of one of the following scenarios:

Activating the buying positions depends on skipping upwards and stabilizing the price above the resistance level of 1.1320, and this may contribute to consolidating the gains to visit 1.1350 first target, and then 1.1385 the pivotal supply area, which is the key to protecting the bearish trend, knowing that the breach of the mentioned level leads the pair to the bullish path again with an initial target of 1.1460.

Reactivating the short positions requires the stability of trading again below 1.1260, and most importantly, 1.1220. From here, the euro is witnessing a resumption of the official descending path to visit the official station 1.1120.

Note: Today, we are awaiting the European Central Bank’s monetary policy statement and the European Central Bank’s press conference, and we may witness high volatility in prices.

| S1: 1.1240 | R1: 1.1320 |

| S2: 1.1190 | R2: 1.1350 |

| S3: 1.1160 | R3: 1.1390 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations