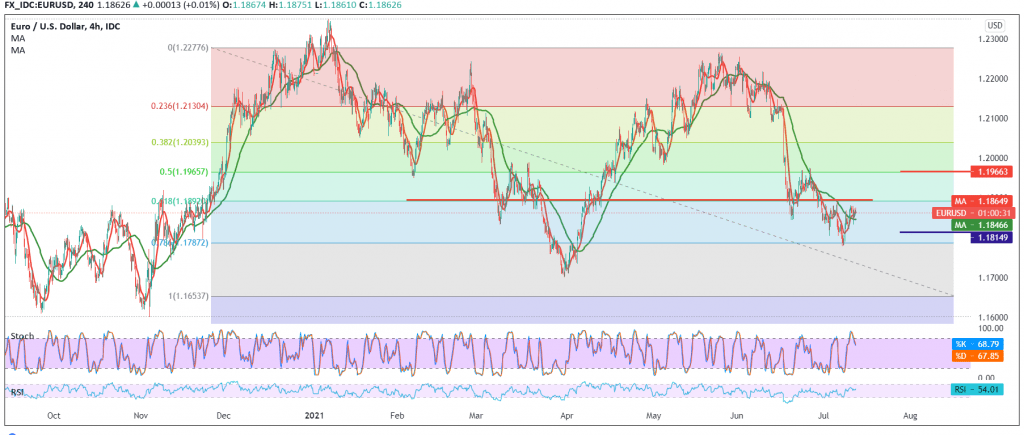

The technical outlook is unchanged, and the EUR has not changed much within a sideways bullish trend. However, technically, and with careful consideration of the 4-hour chart, we find a conflict between the positive motive coming from the 50-day moving average, which is trying to push the price to the upside, and the clear negative features on the stochastic.

With the technical signals conflicting, we prefer to stand aside until the daily trend becomes clearer, waiting for one of the following scenarios:

Activating long positions requires witnessing a clear and strong breach of the resistance level 1.1885/1.1890, Fibonacci correction of 61.80%, and that is a catalyst that increases the possibility of retesting 1.1930 and then 1.1975.

Activating short positions requires confirming the breach of 1.1820/1.1810, and from here, the bearish trend regains control of the euro’s movements in full, targeting 1.1780 and 1.1750, respectively. Losses may extend later to visit 1.1710.

| S1: 1.1810 | R1: 1.1930 |

| S2: 1.1750 | R2: 1.1975 |

| S3: 1.1710 | R3: 1.2010 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations