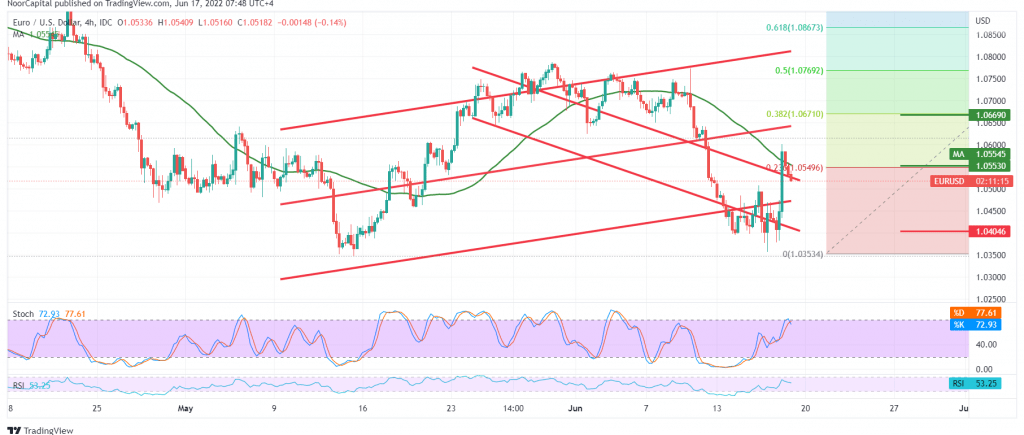

The previous trading session witnessed the performance of the single European currency, which achieved a noticeable rise to reflect the expected negative outlook during the last analysis, in which we relied on the stability of trading below the pivotal resistance level of 1.0500 and, most importantly 1.0550.

We indicated during the previous report that consolidation above 1.0550 would temporarily stop the bearish trend. We also witnessed a bullish corrective slope, whose initial target is 1.0670, recording a high of 1.0600.

Technically, and carefully considering the chart, the current movements of the pair are witnessing intraday stability below the effective resistance 1.0550 represented by the 23.60% Fibonacci correction and converging around the 50-day moving average and adding more strength to it. We find the overbought signs that started to appear on the stochastic.

Despite the technical factors that indicate the possibility of the bearish path, we prefer to monitor the price behavior of the pair around the previously breached resistance level 1.0500 and turned into support because the breach below it renews the chances of the bearish path taking control of the first target 1.0400.

Consolidating above 1.0620 can temporarily thwart the official bearish track’s domination, and the euro is recovering against the US dollar, with the first target of 1.0670, 38.20% correction, and then 1.0770, 50.0% correction.

Note: Federal Reserve’s speech is due later in today’s session, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0400 | R1: 1.0620 |

| S2: 1.0285 | R2: 1.0670 |

| S3: 1.0180 | R3: 1.0770 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations