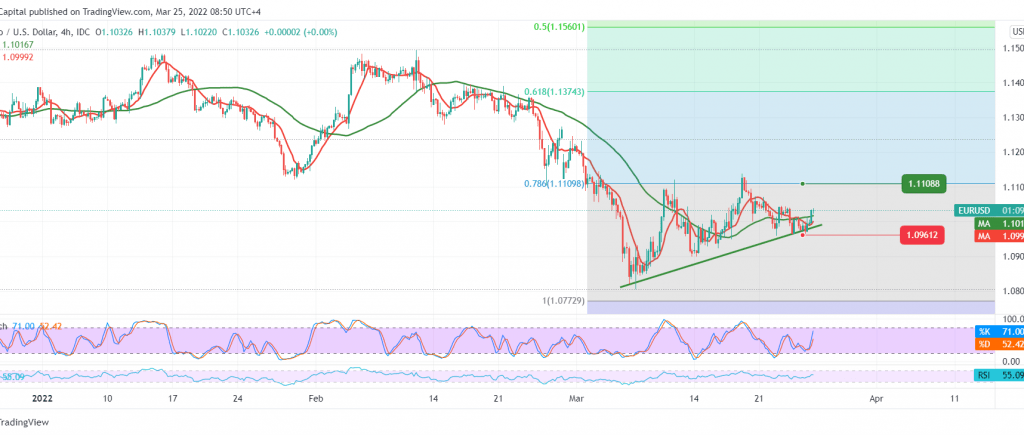

The EUR/USD pair moved in the expected bearish path, but it did not show solid movements for two consecutive sessions, trying to build on 1.0960 support level.

Technically, despite the pair’s attempts to achieve some bullish rebound, benefiting from the pivot on the 1.0960 support floor, we also find that the RSI started to gain bullish momentum.

Despite the technical factors that indicate the possibility of a bullish consolidation, we prefer to confirm the breach of the strong supply area 1.1060, which may facilitate the task required to visit 1.1100. As a result, the gains may extend to visit 1.1130.

Sneaking below 1.0960 leads the price to work within the bearish trend, waiting for 1.0920 and 1.0875, respectively.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0965 | R1: 1.1060 |

| S2: 1.0920 | R2: 1.1105 |

| S3: 1.0870 | R3: 1.1150 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations