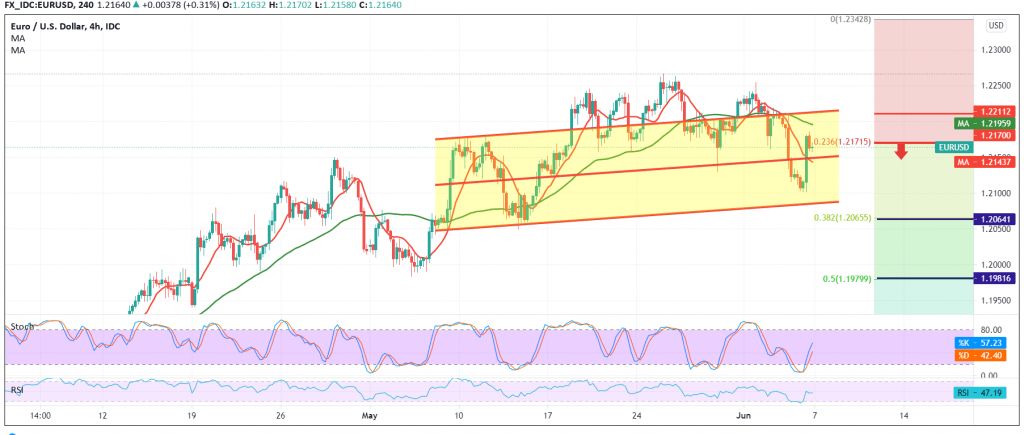

Mixed trading dominated the movements of the euro against the US dollar at the end of last week’s trading, within a bearish tendency, recording its lowest level near the pivotal support level 1.2100.

Technically, the pair bounced today, benefiting from the mentioned support level, within the context of retesting the 1.2170 resistance, 23.60% correction.

The 50-day moving average is still pressuring the price from above, and negative signs started appearing on stochastic on the 4-hour time frame.

From here, and with the continuation of intraday trading below 1.2170 and in general below 1.2210, the bearish scenario remains valid and effective, targeting 1.2110, and then 1.2065 Fibonacci correction 38.20%, an official station awaited.

From the top, a short move up and a rise again above 1.2210 is able to negate the bearish scenario, and the Euro will recover again, heading towards 1.2270 initially.

| S1: 1.2110 | R1: 1.2210 |

| S2: 1.2055 | R2: 1.2270 |

| S3: 1.1995 | R3: 1.2325 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations