The technical outlook is as it is, and the moves of the euro against the US dollar were not significantly changed in quiet trading that tended to be positive amid the US market holiday yesterday.

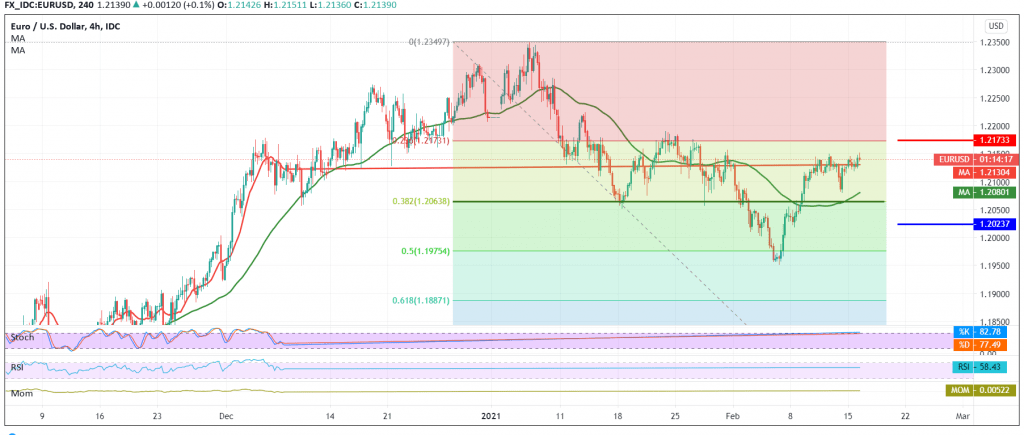

In terms of technical analysis, the Euro found a good support floor around 1.2080. With a closer look at the 60-minute chart, we find the 50-day moving average to hold the price from below and meet around the support level of 1.2080 and add more strength to it, accompanied by the positive signs coming from the RSI and its stability above the 50 midline.

Therefore, we may witness a bullish tendency during the coming hours, targeting a re-test of the 1.2175 resistance level located at the 23.60% Fibonacci correction as shown on the chart, taking into consideration that trading above 1.2175 is a catalyst for a visit to 1.2220.

From below, the return of trading stability below 1.2065 corrections of 38.20% puts the price under negative pressure again, with an initial target of 1.2020.

| S1: 1.2095 | R1: 1.2175 |

| S2: 1.2065 | R2: 1.2205 |

| S3: 1.2020 | R3: 1.2250 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations