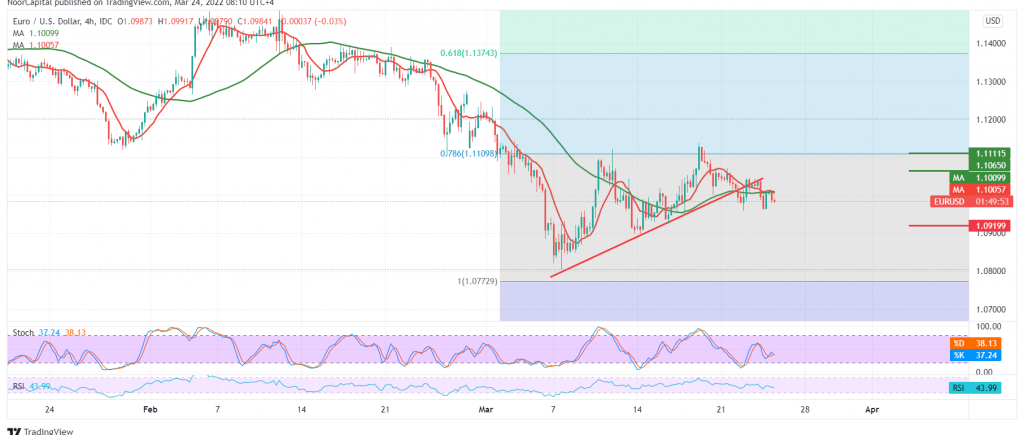

Slow sideways movements tend to dominate EUR/USD negatively, and the intraday movements are still stable below the resistance level 1.1060/1.1050, unable to break it.

Technically, despite the pair’s attempts to achieve some bullish bounce, we still believe that the bearish trend is the most likely, relying on the stability of the intraday trading below the resistance of 1.1060, accompanied by obtaining negative signals coming from the stochastic indicator, which comes in conjunction with the price movement below 50 day moving average.

Therefore, we maintain the same previous technical conditions. The decline below the 1.0965 support level facilitates the task required to visit 1.0920, a next station whose targets may extend later to visit 1.0875.

As long as the price is stable intraday below 1.1060 and in general below the previously broken support level that turned into the 1.1100 resistance level, and only its breach of it may stop the bearish scenario, we witness a bullish bias that aims to retest 1.1150 initially.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0965 | R1: 1.1060 |

| S2: 1.0920 | R2: 1.1105 |

| S3: 1.0870 | R3: 1.1150 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations