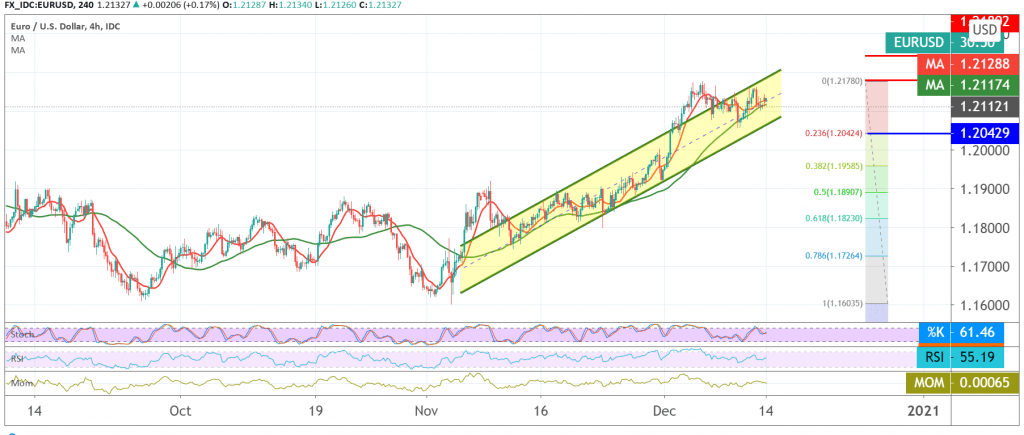

The euro’s movements against the US dollar witnessed a slight bullish tendency, benefiting from stability above the support level of 1.2070, as the current moves in the pair witness a re-test of the 1.2170 resistance level.

On the technical side, we find the 50-day moving average that holds the price on the 4-hour time frame, and we also notice that there are positive signals coming from the RSI on the short time frame.

Despite the technical factors that support the possibility of the upside, we tend to be negative in our trading, depending on the inability of the pair to surpass the resistance level 1.2175 / 1.2180, in addition to the clear overbought on the stochastic indicator.

Therefore, we maintain our negative outlook, knowing that trading below 1.2100 will facilitate the task required to visit 1.2050 and may extend later towards 1.2010.

From the top, confirmation of the pair’s breach of the aforementioned resistance level is capable of negating the bearish scenario, and we may witness an uptrend targeting 1.2220 and may extend to 1.2260.

| S1: 1.2100 | R1: 1.2185 |

| S2: 1.2045 | R2: 1.2220 |

| S3: 1.2010 | R3: 1.2270 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations