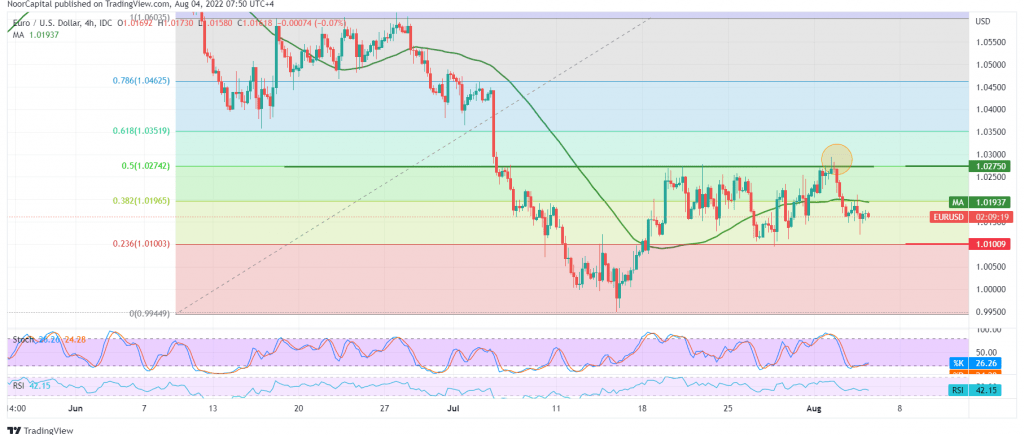

We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, in addition to the limited trading between the daily trend keys published yesterday, explaining that activating the short positions as soon as 1.0150 is broken, targeting 1.0120, to record the pair’s lowest level at 1.0118.

Technically, the pair is trying to build on 1.0120 support level, as we find positive momentum signs on the short time frames that support a bullish bias in the coming hours, which might target a retest of 1.0210 before determining the next price destination.

We prefer to monitor the price behavior of the pair from above 1.0150 because the return of price stability below it supports the idea of touching 1.0120 and 1.0065, while consolidating above 1.0275 the pivotal resistance level represented by the 50.0% Fibonacci correction as shown on the chart, leading the pair again to recover with initial targets that start At 1.0310, it may extend later to visit 1.0350.

Note: High-impact economic data from the British economy is due today; interest rate decision, the Governor of the Bank of England’s speech and the monetary policy statement issued by the Bank of England and the monetary policy summary, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0120 | R1: 1.0210 |

| S2: 1.0065 | R2: 1.0275 |

| S3: 0.9980 | R3: 1.0310 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations