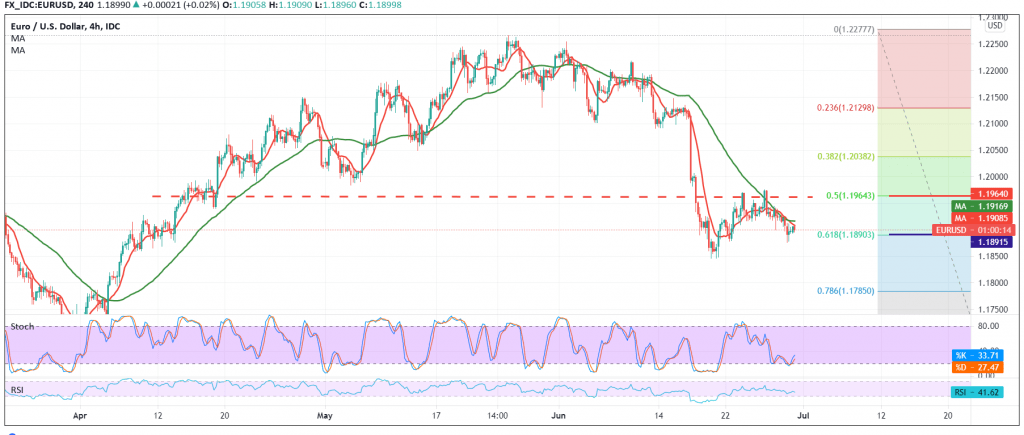

The euro maintains a gradual bearish tendency against the US dollar due to trading stability below the strong resistance level located at 1.1975, to start pressing on the 1.1880 support level.

On the technical side today, and with a careful look at the 240-minute chart, we find the simple moving averages continuing to pressure the price from above, accompanied by the continuation of the clear negative features on the stochastic indicator.

Therefore, we will maintain our negative outlook, knowing that breaking the pivotal support of 1.1880 represented by the 61.80% Fibonacci correction increases and accelerates the downside strength, targeting 1.1840 and 1.1810 respectively downside wave may extend later towards 1.1760.

We have crossed the upside from the top and rose again above the resistance level of 1.1975, the 61.80% correction that can thwart the expected bearish scenario, and we may witness a slight bullish bias that aims to retest 1.2000 and 1.2040, respectively.

Note: The RSI is trying to provide positive signals on short intervals.

| S1: 1.1880 | R1: 1.1940 |

| S2: 1.1845 | R2: 1.1975 |

| S3: 1.1810 | R3: 1.2030 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations