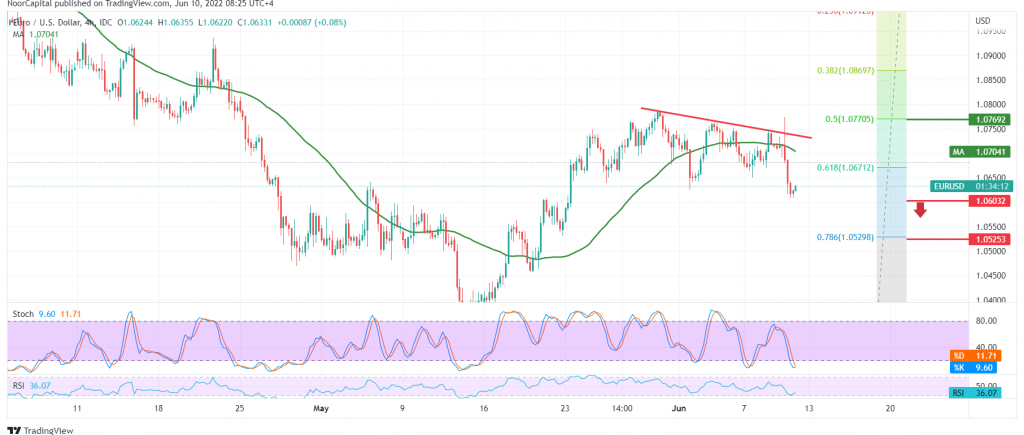

The single European currency declined noticeably during the previous trading session. Therefore, we adhered to intraday neutrality in the last analysis, explaining that activating short positions is confirmed by breaking 1.0670, targeting 1.0600, to record the pair’s lowest level at 1.0610.

Technically and carefully considering the 4-hour chart, we find the pair collided with the main resistance level published during all reports of the current week 1.0770, represented by the 50.0% Fibonacci correction. Furthermore, we find the pair stable below the previously broken support 1.0680, located at 61.80% correction accompanied by Negative pressure of simple moving averages.

Therefore, the possibility of continuing the decline is still valid and effective, provided that the support level of the psychological barrier is confirmed, which increases the relative stability of the pair, and that facilitates the task required to visit 1.0575, a first target, and then 1.0520, and awaited price station, as long as the price is generally stable below 1.0770.

Consolidation above 1.0770 can thwart the bearish trend and lead the euro to a temporary bullish path that targets retesting 1.0830&1.0865.

Stochastic is trying to get temporary positive crossover signals.

Note: Today we are waiting for the “Consumer Prices” index from the US, and we may witness high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0575 | R1: 1.0730 |

| S2: 1.0520 | R2: 1.0830 |

| S3: 1.0430 | R3: 1.0885 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations