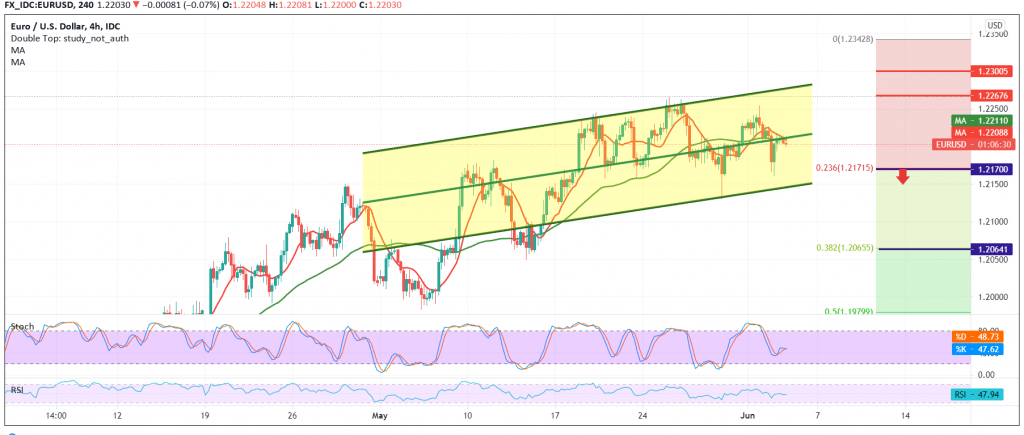

EUR/USD witnessed a bullish bias during the previous trading session, but still a limited bullish, so far the pair has found it difficult to breach the resistance level published in the previous analysis 1.2245, which we explained as one of the conditions for the continuation of the rise.

Technically, by looking at 240 minutes chart, we find the current movements tend to be negative within the conflict of technical signals between the attempts of the 50-day moving average that support the rise, supported by the stability of trading above 1.2170, and between the negative signals that began to appear Stochastic indicator.

From here, we will stand aside for the moment in order to obtain a high-quality deal, waiting for one of the following scenarios:

The continuation of the bullish bias requires daily trading to remain above 1.2170, 23.60% Fibonacci correction. We also need to witness a clear breach of the 1.2245 resistance level, in order to enhance the chances of rising towards 1.2275, and then 1.2300 as a next station.

Activating short positions depends on breaking 1.2170, and from here, the pair may witness a bearish corrective slope, with its official target located around 1.2065, 38.20% correction.

| S1: 1.2170 | R1: 1.2245 |

| S2: 1.2140 | R2: 1.2270 |

| S3: 1.2105 | R3: 1.2305 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations