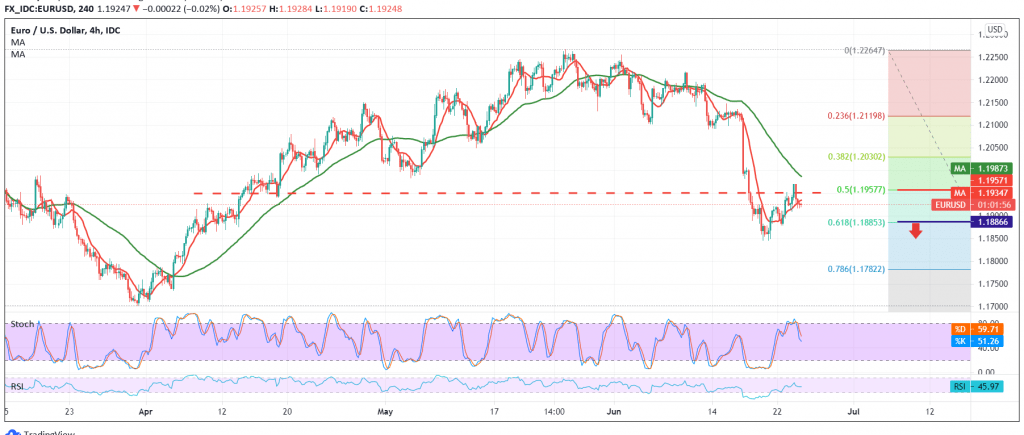

The Euro hit the published pivotal resistance level that is required to be retested during the previous analysis at 1.1970, which still constitutes an obstacle for the pair, unable to breach it until now.

Technically, we are inclined towards negativity in our trading, based on the negative pressure coming from the 50-day moving average, in addition to the clear negative signs on the stochastic indicator.

From here and steadily trading below 1.1975 50.0% Fibonacci correction, the bearish bias is the most preferred today, conditional on confirming the break of 1.1880, retracement of 61.80%, and that facilitates the task required to visit 1.1845 and 1.1810 awaited official stations.

Trading above 1.1975 and price stability above it is able to thwart the bearish scenario, and the pair recovers again with an initial target of 1.1990, and it may extend to 1.2030.

| S1: 1.1800 | R1: 1.1975 |

| S2: 1.1845 | R2: 1.2030 |

| S3: 1.1810 | R3: 1.2120 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations