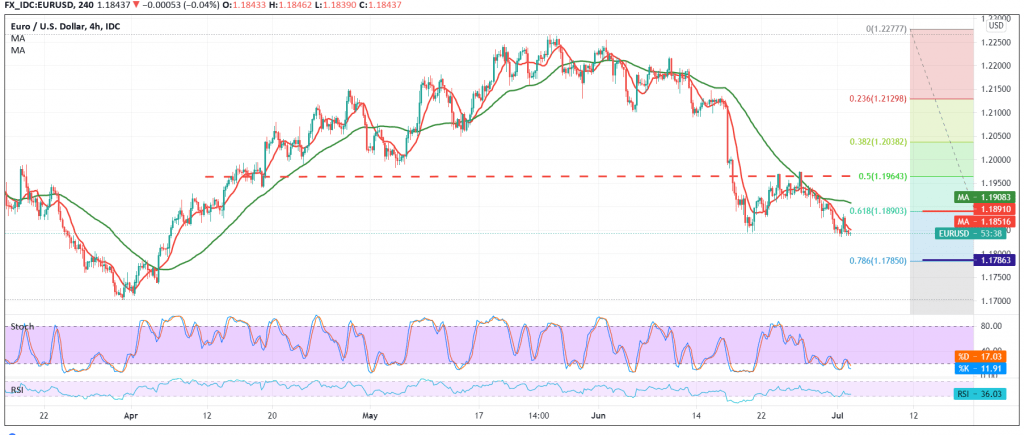

The euro continues to resume the bearish path against the US dollar within a gradual decline to the downside, approaching the official target of 1.1840 by a few points, at the second target 1.1810, posting its lowest level at 1.1835.

On the technical side, and with the continuation of the negative pressure coming from the 50-day moving average, in addition to confirming the pair’s breach of the 1.1880 support level, the 61.80% Fibonacci correction, which is now turned into a strong resistance level.

From here, the bearish scenario will remain valid and effective towards 1.1810/1.1800, and breaking it will extend the pair’s losses, so we will be waiting for 1.1775/1.1770.

Activating the bearish scenario depends on the euro’s stability below 1.1880.

Note: NFP is due today and we may witness high volatility.

| S1: 1.1810 | R1: 1.1890 |

| S2: 1.1770 | R2: 1.1930 |

| S3: 1.1725 | R3: 1.1975 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations