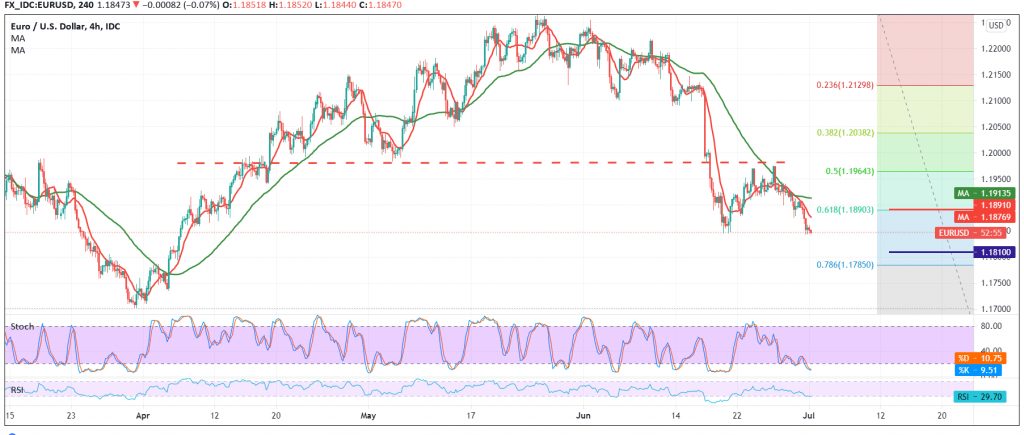

EUR/USD trading within the expected bearish path during the previous analysis, touching the first awaited target at 1.1840, recording its lowest level during the morning session at 1.1844.

On the technical side, the pair succeeded in breaking the 1.1880 level represented by the 61.80% Fibonacci correction, which is now turned into a resistance level, in addition to the continuation of the negative pressure coming from the simple moving averages.

Therefore, we will maintain our negative outlook, towards the next station 1.1810, taking into consideration that the breach of the mentioned level will extend the continuation of the current descending wave so that the path will be opened directly towards 1.1760.

From the top, we can skip upwards and rise again above 1.1890, and most importantly 1.1930 is able to thwart the suggested scenario, and we may witness a retest of 1.1975, 50.0% correction.

In general, we will continue to suggest the bearish trend as long as trading is stable below 1.1975.

| S1: 1.1810 | R1: 1.1890 |

| S2: 1.1760 | R2: 1.1930 |

| S3: 1.1725 | R3: 1.1975 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations