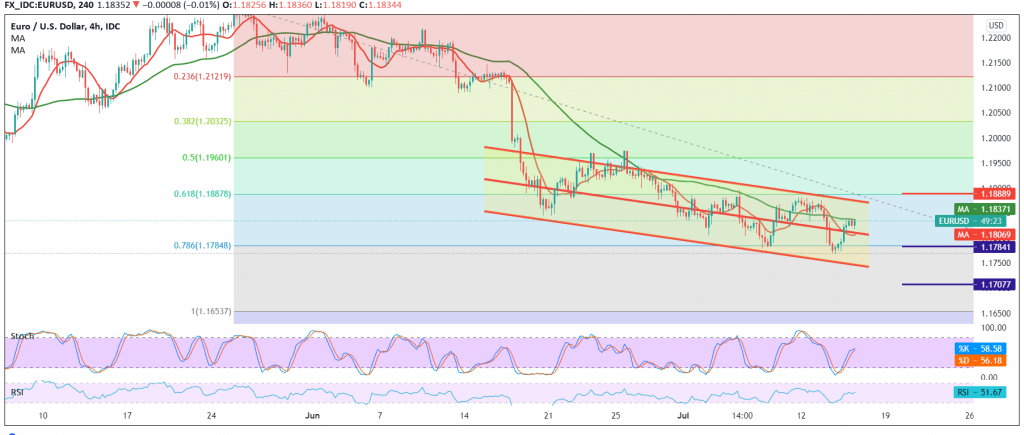

Negative trades dominated the euro’s movements against the US dollar, within the expected negative outlook, in which we relied on breaking 1.1820 to record the lowest price at 1.1770.

On the technical side today, and looking at the 240-minute chart, we find that the 50-day moving average is still pressing on the price from above, accompanied by stochastic losing the bullish momentum gradually.

And with the continuation of the intraday trading stability below the resistance level of 1.1850, and in general below 1.1880, the Fibonacci correction of 61.80%.

This encourages us to maintain our negative expectations, targeting 1.1810, knowing that breaking the mentioned level will facilitate the task required to visit 1.1745, and then 1.1700 next official station.

Trading above 1.1880 will stop the expected bearish scenario, and the euro will recover to retest 1.1930, and gains may extend later towards 1.1975 50.0% correction.

The Euro Continues its Gradual Decline Against The Dollar

| S1: 1.1775 | R1: 1.1850 |

| S2: 1.1745 | R2: 1.1880 |

| S3: 1.1705 | R3: 1.1930 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations