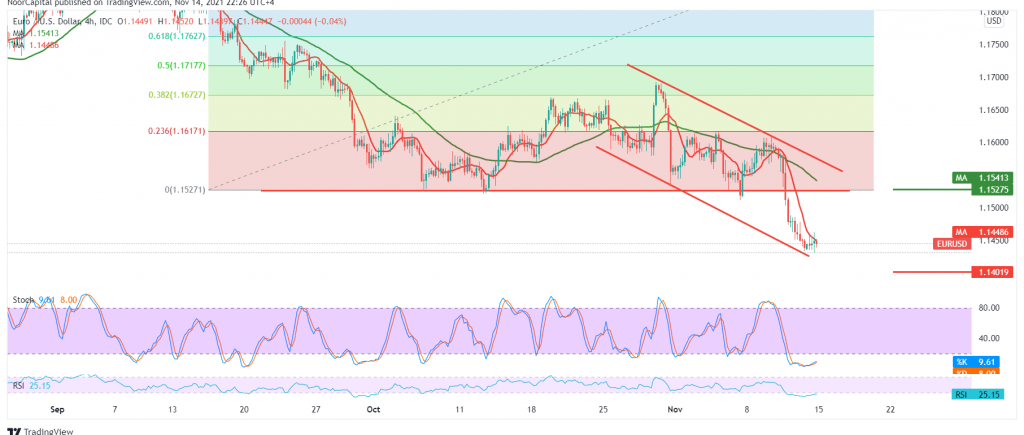

The negative moves continue to dominate the euro against the US dollar within a gradual decline to the downside, heading to 1.1400, recording its lowest price at the end of last week’s trading at 1.1433.

Technically, the bearish scenario is still the most preferred, based on the regularity of move within the bearish price channel shown on the chart, in addition to confirming the breach of the 1.1520/1.1510 support level accompanied by the negative pressure of the simple moving averages, which meets the 50-day moving average around 1.1520 and adds more strength to it.

Therefore, 1.1400 is the official station. It should also be noted that breaking the mentioned level is the key to extending the current descending wave to areas of 1.1300 initially.

Activating the suggested scenario requires daily trading to remain below the 1.1520 resistance level, and its breach will postpone the chances of a decline, and we may witness a retest of 1.1570.

| S1: 1.1400 | R1: 1.1480 |

| S2: 1.1360 | R2: 1.1510 |

| S3: 1.1295 | R3: 1.1570 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations