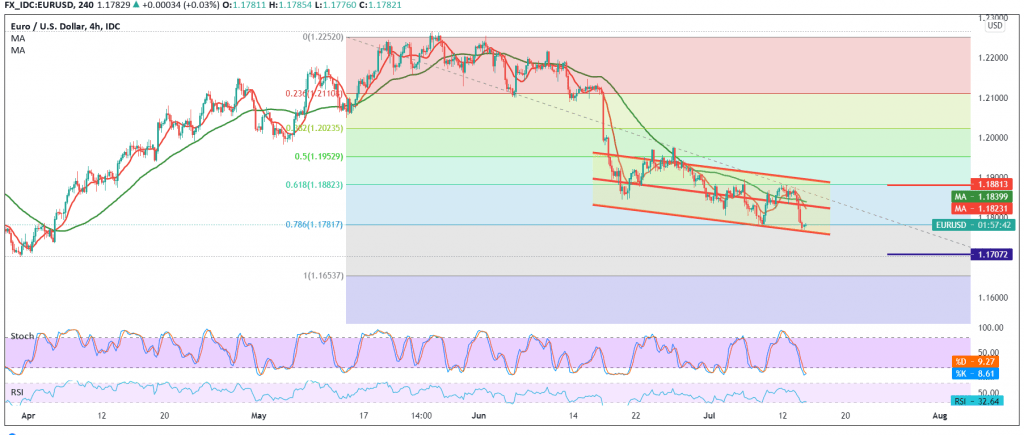

We adhered to intraday neutrality during the previous analysis, explaining that we are waiting to activate the sell orders, which depend on witnessing a breach of the 1.1820 level, in order to target the 1.1770 areas, so that the euro succeeds in touching the first target, recording the lowest price at 1.1872.

Today’s technical aspect indicates the possibility of continuing the decline, relying on the negative pressure coming from the simple moving averages that pressure the price from above and trading below the previously broken support located at 1.1820, in addition to the negative signals coming from the RSI.

Therefore, we complete the bearish targets of the previous report 1.1745, and then 1.4710, an initial official station for the current downside wave, taking into account that the latter’s break extends the euro’s losses so that we are waiting for 1.1650.

On the upside, rising above 1.1850, we continue to suggest the bearish trend unless we witness a breach of 1.1880, 61.80% correction.

| S1: 1.1745 | R1: 1.1850 |

| S2: 1.1710 | R2: 1.1920 |

| S3: 1.1650 | R3: 1.1950 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations