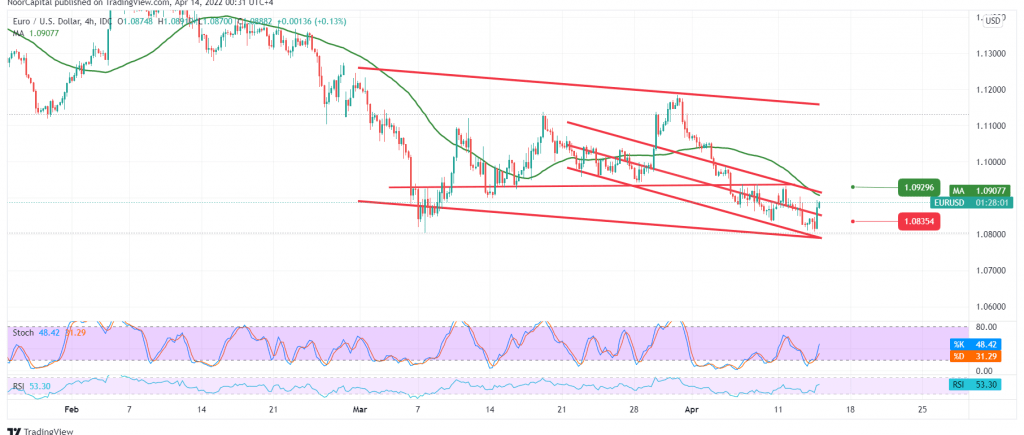

The euro’s movements witnessed a limited bullish tendency after finding a solid support floor near the psychological barrier of 1.0800, which helped the pair make a bullish bounce to test the 1.0900 resistance level.

Technically and carefully considering the 4-hour chart, we notice that the 50-day moving average is still pressing the price from below and still forms an obstacle in front of the pair and meets near the 1.0930 resistance level and adds more strength to it. On the other hand, we find that Stochastic is trying to get more bullish momentum.

With the conflicting technical signals, we prefer to monitor the price behavior of the euro until the trend becomes clearer and to maintain the profitability rates that were achieved during last week’s trading, so that we are facing one of the following scenarios:

Suppose the pair fails to breach the resistance level of 1.0930 and, most importantly, 1.0950. In that case, this makes the bearish scenario valid, knowing that the return of stability below 1.0830 facilitates the task required to complete the general bearish trend to visit 1.0775 and then 1.0735.

Consolidation above 1.0950 is a catalyst that may enhance the chances of a bullish rebound, with initial targets located close to 1.0965, and it may extend later towards 1.1020.

Note: Eyes on ECB and may cause volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0830 | R1: 1.0930 |

| S2: 1.0775 | R2: 1.0965 |

| S3: 1.0735 | R3: 1.1020 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations