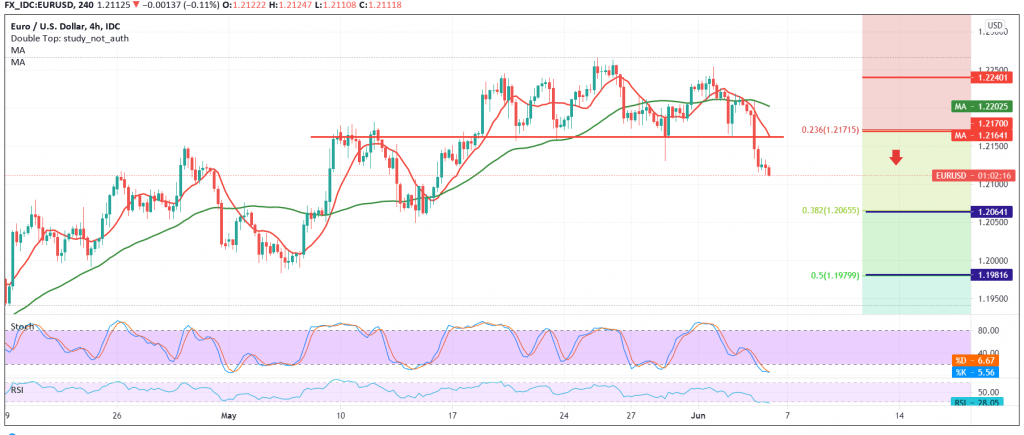

The single European currency declined noticeably against the US dollar within the expected bearish path during the previous analysis, in which we relied on confirming the breach of the 1.2170 level, continuing the gradual decline to the downside, recording the lowest level at 1.2112.

Technically speaking, and with the pair’s success in breaking the 1.2170 level, turning it into a resistance level represented by the 23.60% Fibonacci correction as shown on the chart, in addition to the negative pressure coming from the simple moving averages.

From here, we will maintain our negative outlook within the bearish corrective slope, targeting 1.2065 Fibonacci correction of 38.20%, an official station awaited, knowing that breaking the mentioned level extends the pair’s losses, opening the way directly to 1.2045, and losses may extend later towards 1.2000.

Only from the top, to cross up and rise again above 1.2180, will prevent the chances of a decline, but it does not cancel them, and we may witness a bullish slope that aims to retest 1.2245.

Note: Today we are awaiting US jobs data later in today’s session and we may witness high volatility in prices.

| S1: 1.2075 | R1: 1.2180 |

| S2: 1.2045 | R2: 1.2250 |

| S3: 1.1975 | R3: 1.2285 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations