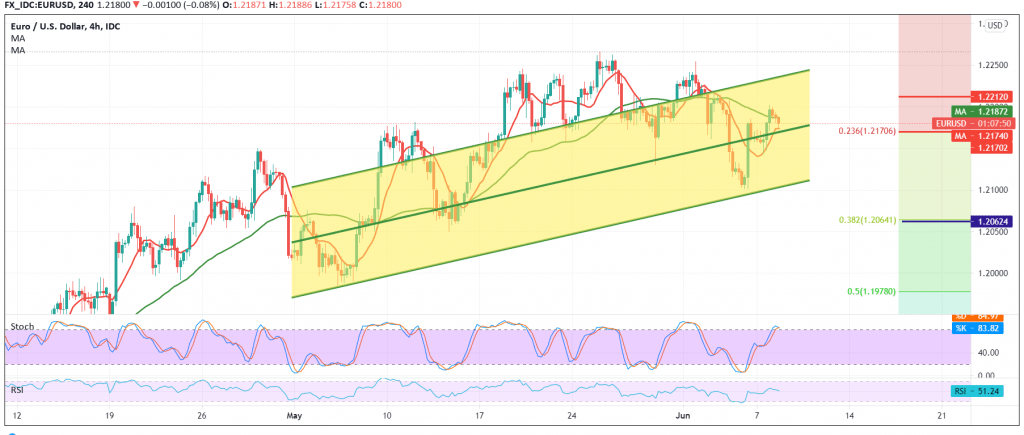

Mixed trading dominated the movements of the euro against the US dollar during the previous trading session, to witness the current movements of the pair attempts to stabilize above the resistance level of 1.2170.

On the technical side today, and by looking at the 240-minute chart, we find the 50-day moving average that is still pressing on the price from above, as well as stochastic is trading near the overbought phase and started to gradually lose the bullish momentum.

We tend to be negative, but we await confirmation of breaking 1.2170, the 23.60% Fibonacci retracement, and most importantly 1.2150. This facilitates the task required to visit 1.2110, a first target, taking into account that any trading below 1.2110 puts the price under negative pressure. Its official target is around 1.2065, 38.20% correction.

From the top, the overshoot and rise again above 1.2210 is able to thwart the likely bearish slump, and the euro may recover again against the dollar, with initial targets starting around 1.2260.

| S1: 1.2150 | R1: 1.2210 |

| S2: 1.2110 | R2: 1.2230 |

| S3: 1.2065 | R3: 1.2265 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations