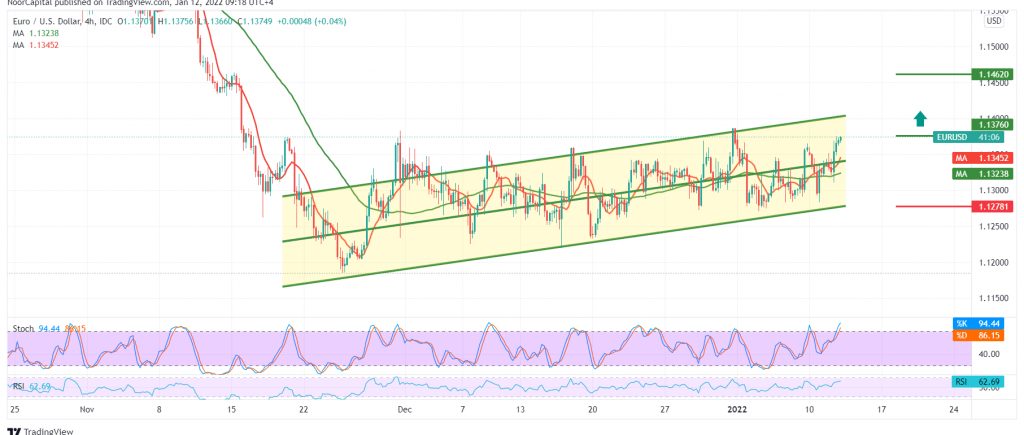

The euro’s movements against the US dollar witnessed a positive trading session to move away from the psychological barrier of 1.1300 support floor and is now hovering around the highest level during the early trading of the current session 1.1375.

On the technical side, the pair starts attacking the main bid area around 1.1375, representing one of the most important directional keys. With careful consideration of the 4-hour chart, we notice that the pair obtained a positive stimulus from the 50-day moving average, accompanied by positive signals on the momentum indicator of 14 days.

We tend to be positive, but the condition of confirming the breach of the pivotal resistance level 1.1380 may increase the continuation of the bullish tendency to target 1.1400 and 1.1420, respectively. It should be noted that the recent breach is a catalyst that enhances the possibility of touching the 1.1460 first stop.

In general, we continue to suggest the bullish daily trend as long as the price is stable above the strong demand area 1.1280, and breaking it may cancel the bullish scenario and put the price under negative pressure again, its initial target is 1.1220, while its official target is at 1.1165.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 1.1330 | R1: 1.1400 |

| S2: 1.1270 | R2: 1.1460 |

| S3: 1.1220 | R3: 1.1510 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations