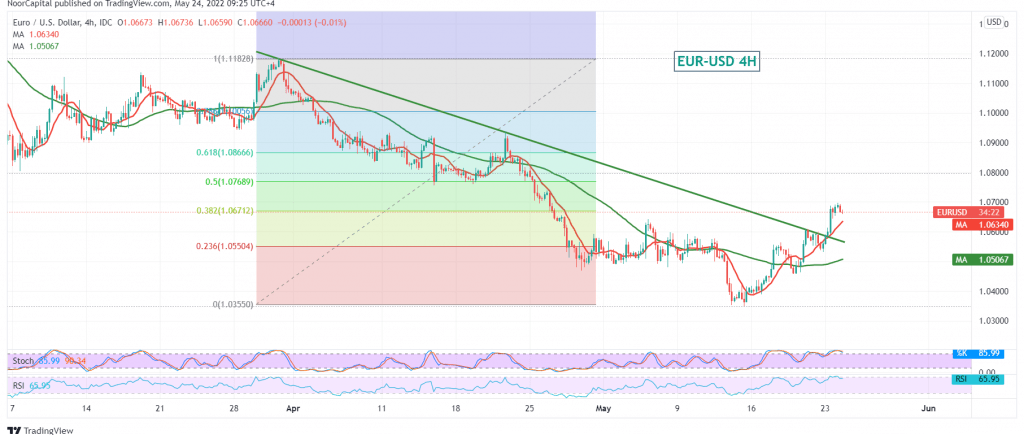

The Euro provided a trading session in positive areas against the US dollar after it succeeded in building on the support floor of 1.0550 and the Euro’s success in breaching 1.0630, reaching its highest level during the previous trading session 1.0697.

Technically, and by carefully looking at the 4-hour chart, we notice that the simple moving averages continue to support the bullish price curve and the clear positive signs on the 14-day momentum indicator on the short time frames.

Steadily intraday trading is above 1.0580, and in general, above 1.0550, 23.60% Fibonacci correction, as shown on the chart. Therefore, the bullish scenario is the most preferred, targeting 1.0720, a first target, and its breach is a catalyst that enhances the chances of rising towards 1.0770, 50.0% correction.

The Decline below 1.0550 can completely thwart the proposed scenario and lead the Euro to the official descending path again, so we will be waiting for 1.0460 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0580 | R1: 1.0720 |

| S2: 1.0505 | R2: 1.0775 |

| S3: 1.0445 | R3: 1.0855 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations