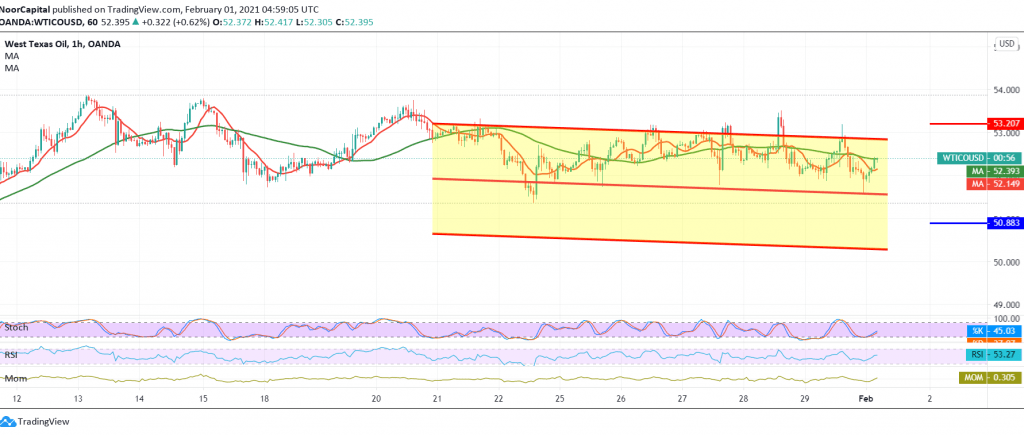

US crude oil futures prices failed to stabilize for a long time above the psychological barrier resistance of 53.00, as trading witnessed a return to the bearish bias once again, stabilizing below the resistance level of 52.70.

Technically, we are biased negatively depending on the negative pressure coming from the 50 day MA. We target 51.60 as a first target, knowing that trading below the aforementioned level is extending oil’s losses, so that the way is open directly towards 50.80, an official next stop that may extend its targets later towards 50.10.

Only from the top, the crossing to the upside and rising again above 53.20 is able to negate any attempts to decline, and crude oil regains its recovery with a target of 54.00.

| S1: 51.60 | R1: 53.20 |

| S2: 50.80 | R2: 53.95 |

| S3: 50.00 | R3: 54.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations