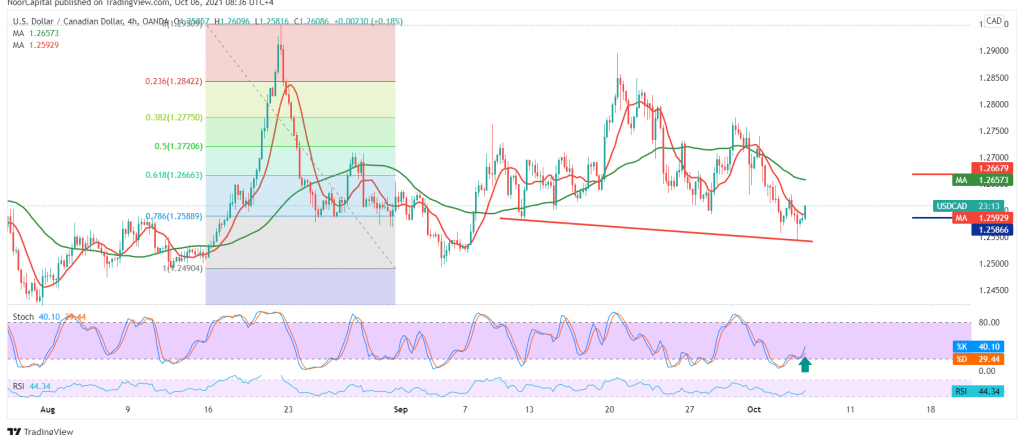

The Canadian dollar provided negative trading yesterday after it failed during the previous session to maintain trading above the strong support at 1.2600, to record the pair’s lowest level at 1.2545.

Technically, we notice the return of the intraday stability above the psychological support 1.2. Furthermore, by looking at the 60-minute chart, we find that the RSI shows positive signs that will motivate the price to rise temporarily.

Therefore, we may witness a bullish bias in the coming hours, targeting a retest of 1.2660, Fibonacci 61.80% initially, and the price behavior of the pair should be monitored around this level due to its importance. Its breach contributes to consolidating gains towards 1.2720, 50.0% correction.

Trading below 1.2545 leads the pair directly to visit 1.2500, the next awaited station.

| S1: 1.2560 | R1: 1.2660 |

| S2: 1.2510 | R2: 1.2720 |

| S3: 1.2470 | R3: 1.2770 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations