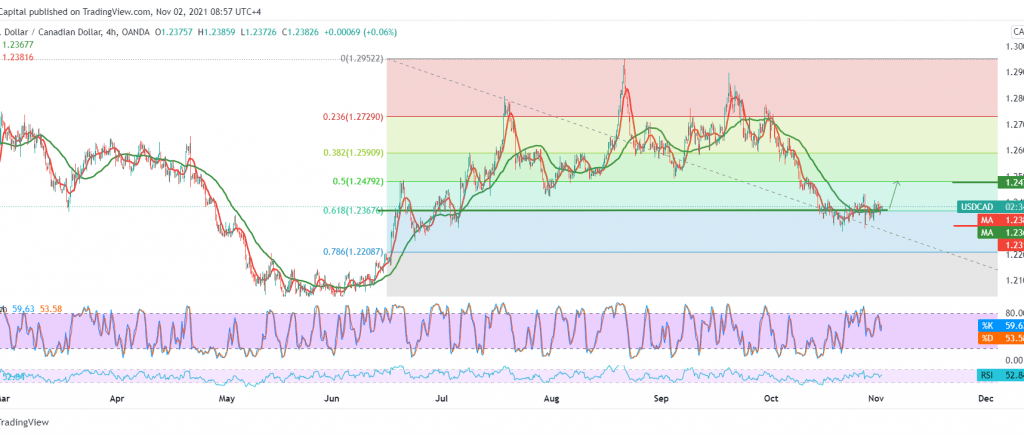

The Canadian dollar maintained its limited gains that were achieved at the end of last week’s trading, after it succeeded in establishing a good support floor around the 1.2300 level, and is still hovering around its highest level during today’s early trading session 1.2390.

Technically, we notice the return of the 50-day moving average to hold the price from below, supporting more rise, which comes in conjunction with the RSI receiving bullish momentum signals on the short time frames.

We tend to have a bullish bias during today’s trading session, as long as we confirm the breach of 1.2410. This is a catalyst that contributes to achieving gains targeting 1.2455 and 1.2475, 50.0% Fibonacci correction.

Only from below, the return of stability below 1.2330, and most importantly 1.2300, can thwart the current attempts to rise and lead the pair to resume the official descending path, with a target of 1.2240.

| S1: 1.2330 | R1: 1.2415 |

| S2: 1.2290 | R2: 1.2455 |

| S3: 1.2255 | R3: 1.2490 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations