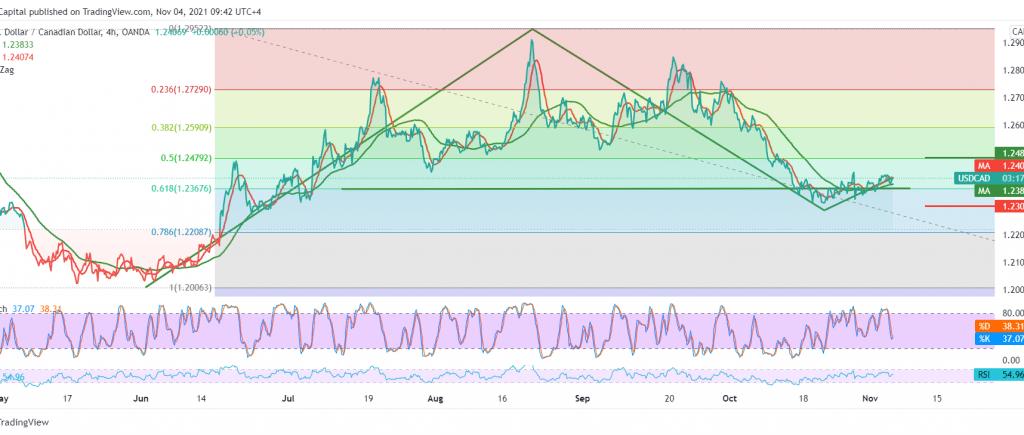

The Canadian dollar continued moving within the bullish correction path we mentioned in the previous analysis, touching the first correction target at 1.2455, recording the highest level at 1.2457.

Today’s technical aspect indicates the possibility of continuing the rise, relying on the positive motive of the 50-day moving average that started holding the price from below, in addition to stabilizing intraday trading above the 1.2370 support level 61.80% Fibonacci correction, as shown on the graph.

Therefore, chances of the rise still exist, knowing that the breach of 1.2455 is a catalyst that strengthens the pair’s gains to visit 1.2480 represented by the 50.0% correction.

In general, we continue to suggest the bullish correction as long as trading is stable in general above the main support level at 1.2300.

| S1: 1.2330 | R1: 1.2455 |

| S2: 1.2300 | R2: 1.2480 |

| S3: 1.2240 | R3: 1.2530 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations