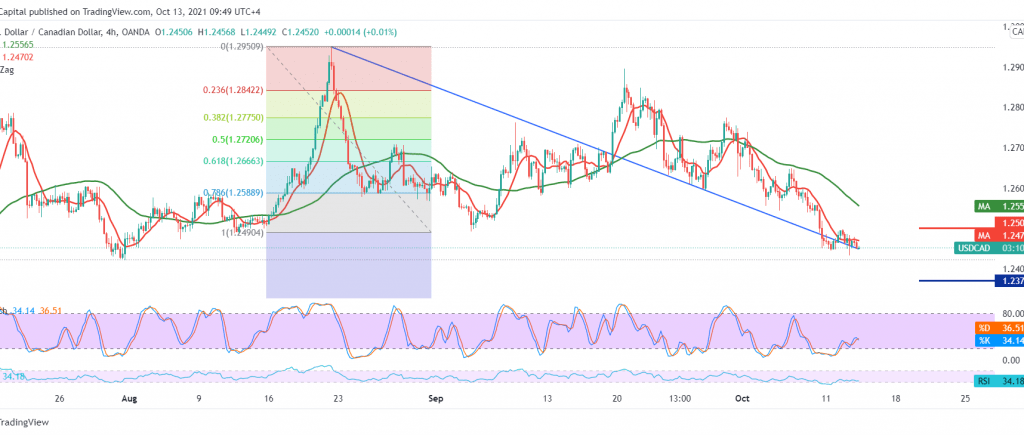

The Canadian dollar failed to confirm breaching the psychological resistance level of 1.2500, which we mentioned during the previous analysis. Instead, it represents the key to the beginning of a bullish bias, which forced the pair to trade negatively again, recording the lowest level at 1.2434.

Technically, today, and carefully looking at the chart, we notice that stochastic is losing bullish momentum on the 4-hour time frame, but the pair’s pivot above the 1.2445 support level accompanied by positive signs that started appearing on the RSI increases the possibility of witnessing a slight bullish slope, but with conditions.

We tend to the intraday positivity, conditional on confirming the breach of 1.2500, targeting 1.2540 and 1.2570, respectively, as long as trading is stable above 1.2540/12545 because breaking it is capable of diverting the pair’s direction to the official bearish track with a target of 1.2400 and 1.2365. Note: Risk level is high.

| S1: 1.2450 | R1: 1.2500 |

| S2: 1.2400 | R2: 1.2540 |

| S3: 1.2355 | R3: 1.2570 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations