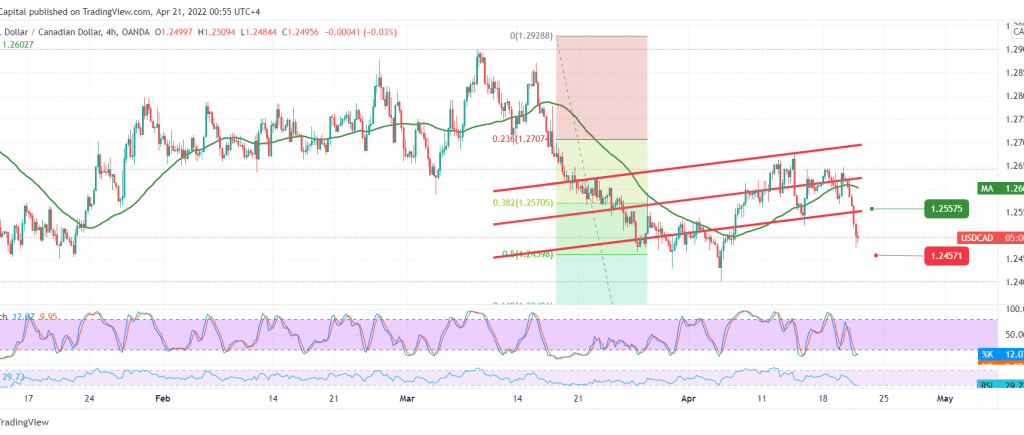

The Canadian dollar declined noticeably, canceling the expected positive outlook in the previous analysis, in which we relied on the stability of trading above the 1.2570 level. Accordingly, we indicated that any trading below 1.2570 will postpone the attempts to rise and put the pair under negative pressure to target 1.2510, recording the lowest level at 1.2470, compensating for the long position.

Technically and carefully considering the 4-hour chart, the stochastic indicator has reached the oversold areas. Therefore, we are expanding the risk appetite, relying on the intraday stability above 1.2460, 50.0% correction, which may lead the pair to attempt a rise in the coming hours, to test 1.2560 In principle.

Declining below 1.2450, 50.0% correction, leads the pair directly to resuming the decline towards 1.2440 and 1.2400.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations