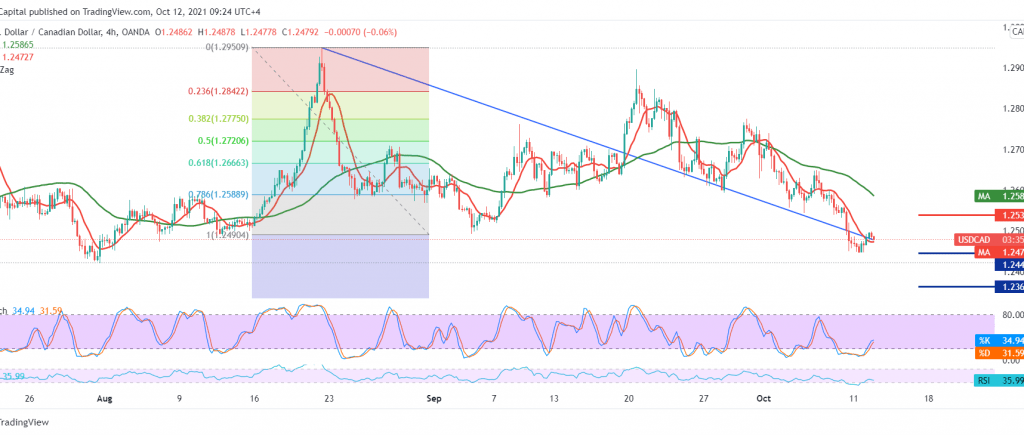

The Canadian dollar found an excellent support floor around the support level posted during the previous analysis at 1.2445, forcing it to retest the previously broken support level and now turn into the 1.2500 resistance level.

Technically, and by carefully looking at the chart, we notice that the stochastic indicator lost the bullish momentum due to the bullish rebound attempts that occurred yesterday. Still, the pair’s pivot above the 1.2445 support level accompanied by positive signs that started appearing on the RSI increases the possibility of witnessing a slight bullish slope.

We tend to the intraday positivity, conditional on confirming the breach of 1.2500, targeting 1.2540 and 1.2570, respectively, as long as trading is stable above 1.2540/12545, breaking it is capable of diverting the pair’s direction to the bearish path with a target of 1.2400 and 1.2365. Note: Risk level is high.

| S1: 1.2450 | R1: 1.2500 |

| S2: 1.2400 | R2: 1.2540 |

| S3: 1.2355 | R3: 1.2570 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations