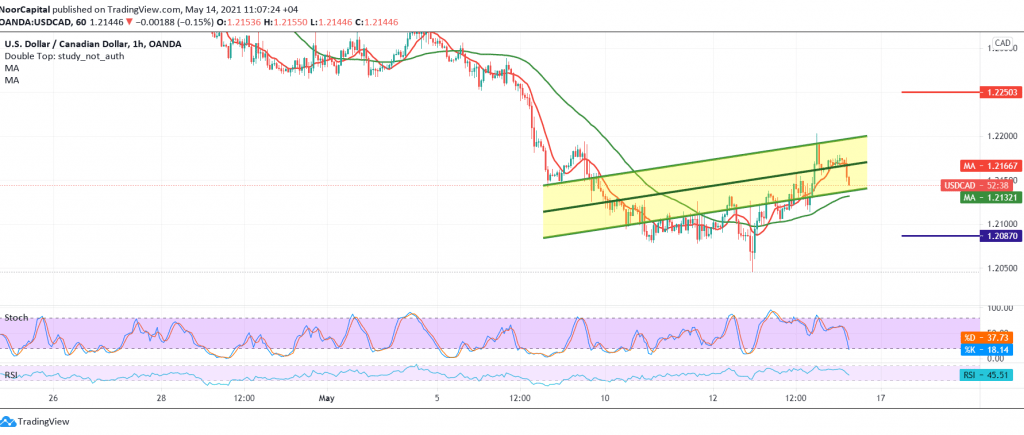

The Canadian dollar was able to achieve the official target of the bullish corrective tendency mentioned in the previous analysis, located at 1.2170, to hit its highest level during the last session’s trading at 1.2203.

Technically, we tend to be positive, relying on the price to base itself above the support floor of 1.2110/1.2090 accompanied by the positive stimulus of the 50-day moving average, which returned to hold the price from below.

Therefore, the bullish corrective bias is the most preferred today, targeting 1.2200 and then 1.2250 respectively, knowing that confirming the breach of 1.2250 extends the pair’s gains, opening the way for a re-test of 1.2310. Activating the bullish scenario requires stability in general above 1.2090.

| S1: 1.2100 | R1: 1.2200 |

| S2: 1.2050 | R2: 1.2250 |

| S3: 1.2000 | R3: 1.2310 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations