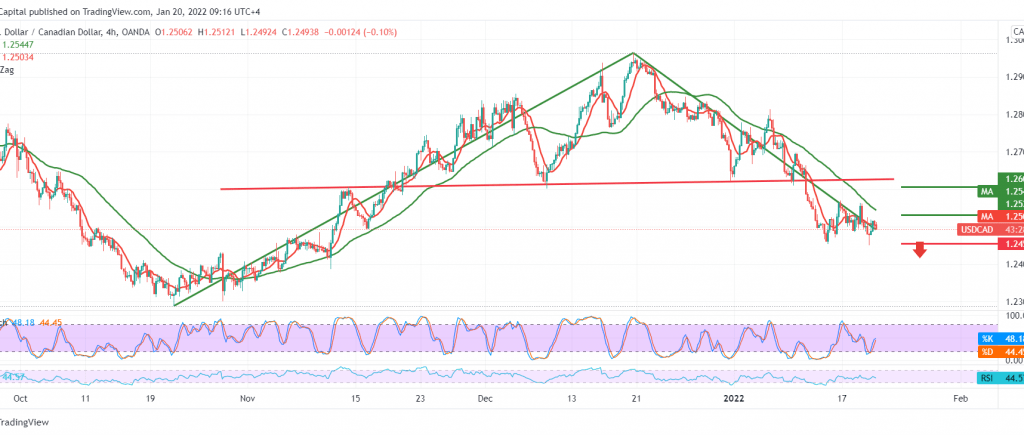

Negative trading dominated the Canadian dollar’s movements, trying to pressure the pivotal support level at 1.2465 to end its daily trading above that level.

Technically, there is a conflict in the technical signals between the attempts of the stochastic indicator to obtain positive signals that increase the possibility of an intraday rise as a result of stability above 1.2465 and between the negative pressure of the 50-day moving average that supports the bearish curve in prices.

We prefer to remain neutral for the third session in a row until a more signal becomes apparent, waiting for one of the following scenarios:

Price stability above 1.2465 may support a bullish bias, as we need to witness a breach of the price above 1.2540, which is a catalyst that increases the probability of touching 1.2570 & 1.2610.

Breaking the low of 1.2465 will increase the bearish trend so that the door will be open towards 1.2425 and 1.2380, respectively.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 1.2465 | R1: 1.2540 |

| S2: 1.2425 | R2: 1.2570 |

| S3: 1.2380 | R3: 1.2610 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations