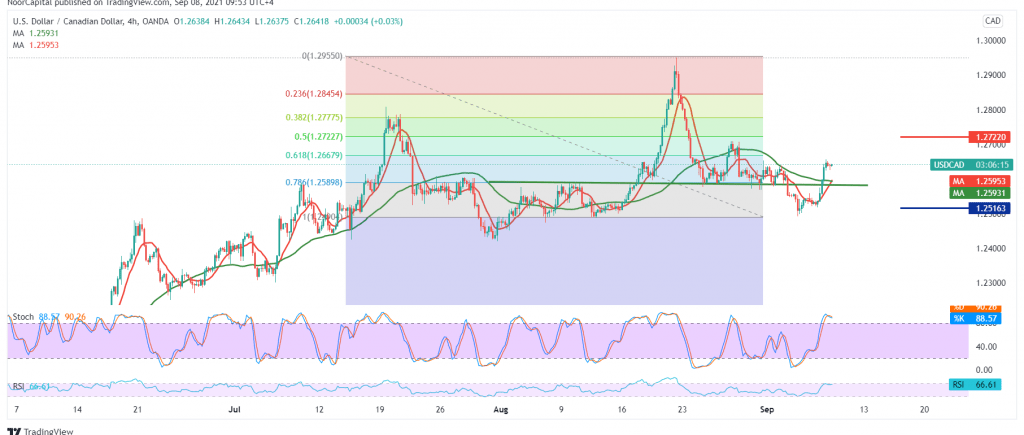

Positive moves regained control of the Canadian dollar after building a solid support floor located at 1.2550 to succeed in retesting the resistance level of 1.2660.

Technically, the pair continues to obtain positive stimulus from the simple moving averages that support the bullish price curve, in addition to the RSI gaining bullish momentum.

From here and steadily intraday trading above 1.2600 and in general above 1.2550 increases the possibility of continuing the rise, targeting 1.2670, the first target of the 61.80% Fibonacci correction, knowing that the breach of the mentioned level is a catalyst that contributes to enhancing the chances of rising towards 1.2720, 50.0% correction, the next official station.

| S1: 1.2560 | R1: 1.2690 |

| S2: 1.2470 | R2: 1.2740 |

| S3: 1.2420 | R3: 1.2820 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations