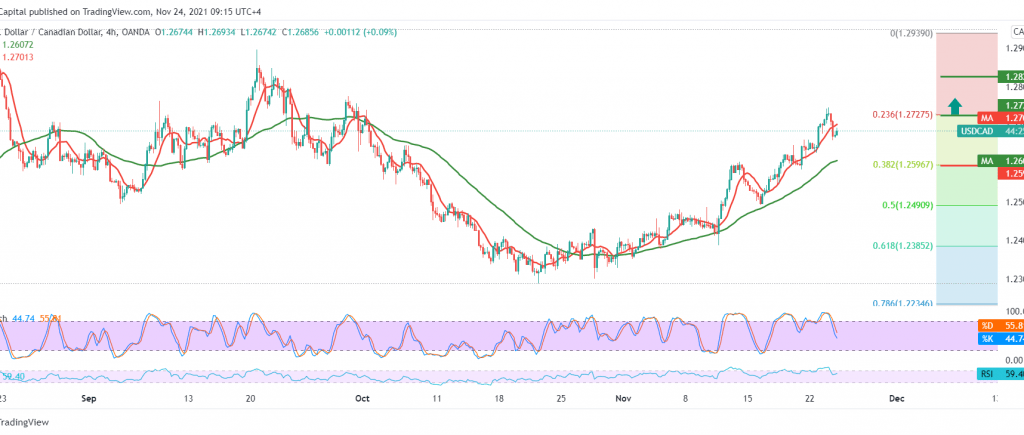

The Canadian dollar could trade within the bullish correction tendency indicated during the past weeks, recording the highest level at 12745. However, the intraday movements are witnessing temporary adverse movements that hit the resistance level 1.2730 23.60% correction.

Technically, and carefully looking at the 4-hour chart, we notice that the simple moving averages continue to support the bullish price curve, in addition to the pair’s success in stabilizing above the 1.2595 resistance level, 38.20% correction, which is now turned into a support level, in addition to the stability of the 14-day momentum indicator.

Therefore, the bullish scenario will remain valid and effective, knowing that the confirmation of breaching 1.2720 increases and accelerates the strength of the bullish bias today, targeting 1.2770 and 1.3830, respectively.

In general, we suggest the overall bullish trend as long as trading is stable above 1.2595. Note: Stochastic is trying to get rid of the current negativity.

| S1: 1.2650 | R1: 1.2730 |

| S2: 1.2595 | R2: 1.2770 |

| S3: 1.2530 | R3: 1.2830 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations