The Canadian dollar declined noticeably yesterday, nullifying the positive outlook as we expected, in which we relied on the price stability above the 1.2700 level, touching the stop losses order published during the last report at 1.2720; we indicated that if 1.2720 is broken, this can thwart the bullish scenario and puts the price under negative pressure. Its target is 1.3630, to record its lowest price at 1.3633, compensating part of the losses of the long position.

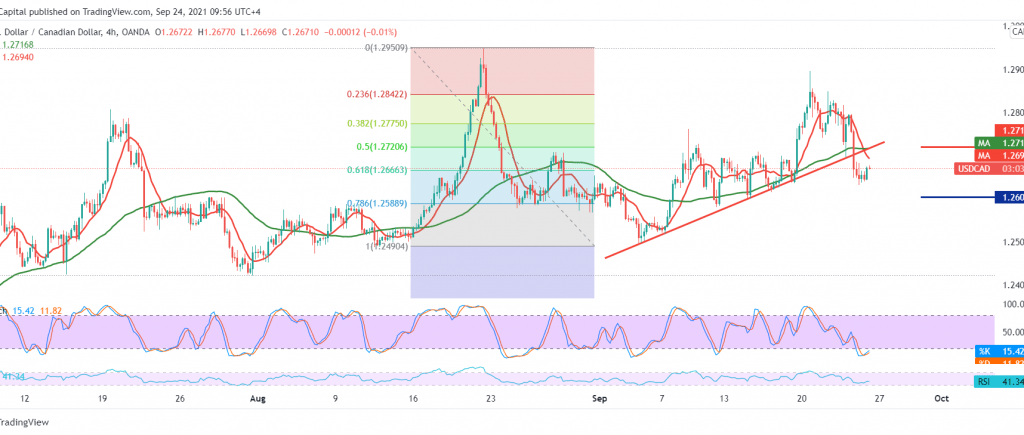

Technically, and by looking at the 240-minute chart, we notice the price stability below 1.2720, the previously broken support-into-resistance, 50.0% Fibonacci retracement as shown on the chart, in addition to the negative pressure coming from the 50-day moving average.

Therefore, the bearish tendency is likely today, targeting 1.2600. It should also be noted that activating the bearish scenario requires trading stability below 1.2770, and its breach can thwart the proposed scenario. Therefore, the pair restores the official bullish path with an initial target of 1.2840.

| S1: 1.2600 | R1: 1.2770 |

| S2: 1.2540 | R2: 1.2865 |

| S3: 1.2445 | R3: 1.2930 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations