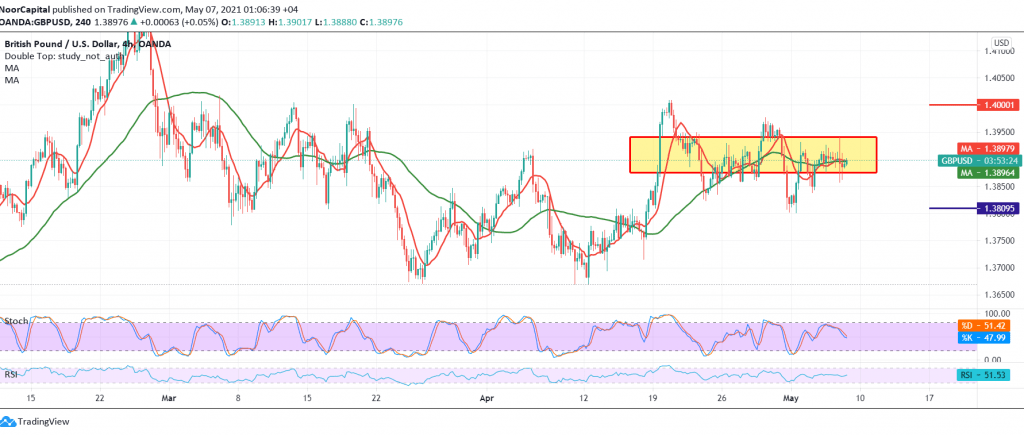

The resistance levels published during the previous analysis, located at 1.3940, managed to pressure the British pound significantly, which forced it to trade negatively, as we expected to touch the target of a re-test of 1.3875, recording a low of 1.3855.

On the technical side, the pair’s movements returned to recede in the same sideways range, to settle from the bottom above the support 1.3875, which is a positive factor, and from below below 1.3940, which constitutes an obstacle to achieving an upside.

Therefore, we will stand aside for the moment, to be in front of one of the following scenarios: The continuation of the bearish trend requires us to witness a break of 1.3870/1.3860, in order to facilitate the task required to visit 1.3810, and losses may extend later towards 1.3765.

Activation of long positions depends on confirming the breach of 1.3940, which is a catalyst that enhances chances of a visit to 1.3980/1.4000, and gains may extend towards 1.4020.

| S1: 1.3850 | R1: 1.3940 |

| S2: 1.3810 | R2: 1.3980 |

| S3: 1.3765 | R3: 1.4020 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations