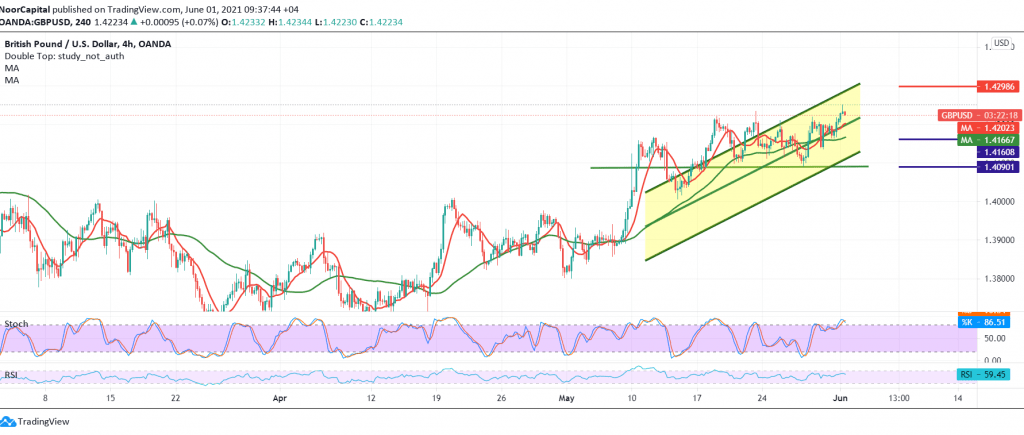

We committed to the intraday neutrality during the previous analysis due to the inconsistency between the technical signals, indicating that the activation of long positions requires the breach of the 1.4220 resistance level, targeting 1.4255, to approach a few points difference from the first target, recording a high of 1.4250 during the morning trading of the current session.

On the technical side today, we notice that there is a clear buying momentum on the short intervals, and we find the 50-day moving average that supports the daily bullish curve for prices.

Therefore, we may witness a bullish bias, provided that the breach of 1.4250 is confirmed to enhance chances of rising towards 1.4265 and 1.4300 respectively, and gains may extend later towards 1.4340. Activating the bullish scenario depends on intraday trading stability above the pivotal support 1.4090.

| S1: 1.4175 | R1: 1.4265 |

| S2: 1.4125 | R2: 1.4300 |

| S3: 1.4090 | R3: 1.4350 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations