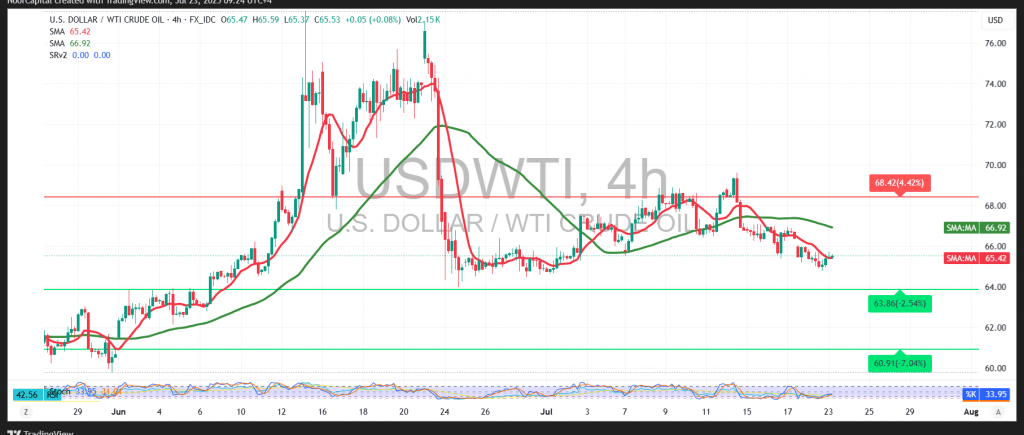

WTI crude oil futures extended their losses during the previous session, pressured by technical selling, as prices moved closer to the first downside target at $64.70, reaching an intraday low of $64.85 per barrel.

Technical Outlook – 4-Hour Timeframe:

The price is currently attempting to hold above the psychological support at $65.00, supported by bullish signals from the Relative Strength Index (RSI), which is recovering from oversold territory. However, simple moving averages are acting as strong dynamic resistance around $65.80, limiting any significant rebound attempts in the short term.

Probable Scenario – Bearish Bias:

As long as the price remains below $65.80, and more importantly below $66.00, the outlook remains bearish. A confirmed break below $65.00 would likely accelerate downside pressure, targeting:

- $64.70 (first support)

- Followed by $64.45, and

- $64.00 as the next major support level

Alternative Scenario – Temporary Recovery:

If the price manages to reclaim $66.00 with a confirmed close above it, we may witness a short-term recovery, targeting:

- $66.45, followed by

- $66.85 as resistance levels

Caution:

The risk level remains high amid continued geopolitical uncertainty and trade tensions. Volatility may increase sharply, and all scenarios remain possible. Traders should apply disciplined risk management.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations