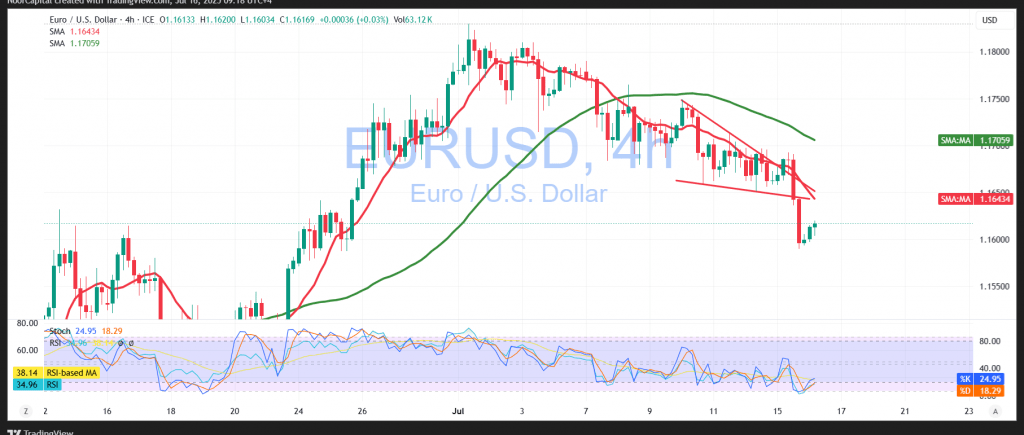

The EUR/USD pair extended its decline in the previous trading session, in line with the bearish outlook outlined in the prior technical report. The pair reached the expected target at 1.1610, recording a session low of 1.1593.

Technical Outlook – 4-Hour Timeframe:

Intraday price action reflects attempts at recovery driven by oversold conditions, supported by early bullish signals on the Relative Strength Index (RSI) in the short-term view. However, the pair continues to trade below the 50-period Simple Moving Average, maintaining the validity of the corrective downward trend.

Probable Scenario – Bearish Bias:

As long as the price remains below 1.1665, the downtrend is expected to continue. A confirmed break below the key support level at 1.1600 would reinforce the bearish momentum, opening the door to further downside targets at 1.1575, followed by 1.1540.

Alternative Scenario – Bullish Rebound:

A breakout above 1.1675 and a sustained move above that level would signal a shift in momentum. In that case, the pair may attempt a recovery toward the key resistance zone at 1.1730.

Market Catalyst:

Traders should remain cautious ahead of today’s release of U.S. Core Producer Price Index (PPI) data (monthly and annual), which may trigger heightened volatility in the market.

Caution:

Risk remains elevated amid ongoing trade tensions. All market scenarios are possible, and prudent risk management is essential.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations