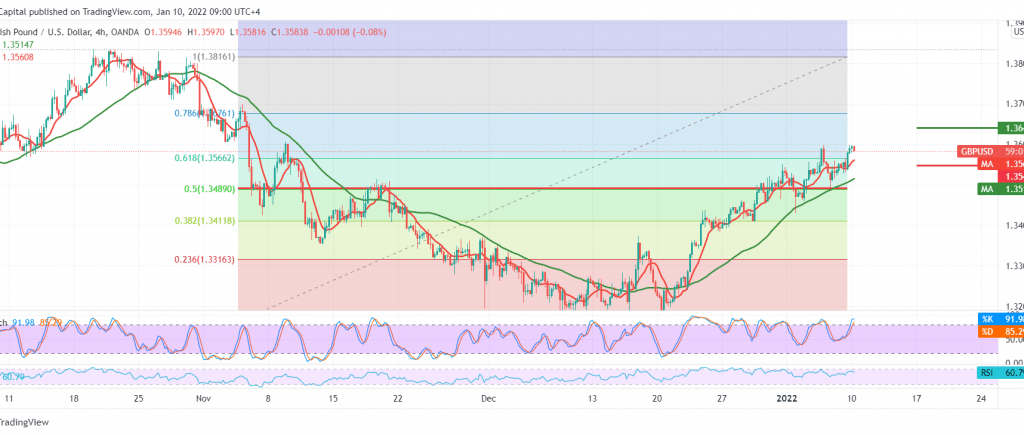

The British pound witnessed a positive trading session at the end of last Friday’s trading after it managed to breach the resistance level of 1.3570, heading towards the psychological barrier of 1.3600, recording its highest level during the early trading of the current session at 1.3598.

On the technical side today, by looking at the 4-hour chart, we notice the pair’s attempts to stabilize above the 1.3570 resistance level represented by the 61.80% Fibonacci correction, accompanied by the positive motive for the 50-day moving average.

We may witness a bullish bias during today’s session, but with caution, targeting 1.3615 first target, knowing that breaching the mentioned level can consolidate the pound’s gains towards 1.3640.

The return of trading stability below the minor support level 1.3550 will postpone the chances of rising, and we may witness a retest of 1.3500 and 1.3470 before attempts to rise again.

Note: CFD trading involves risks, all scenarios may occur.

| S1: 1.3540 | R1: 1.3615 |

| S2: 1.3500 | R2: 1.3640 |

| S3: 1.3470 | R3: 1.3680 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations